- Boost Profits by Connecting Accounting and Project Management

- Why Your Projects Need Financial Clarity

- The Growing Need for Efficiency

- The Real Costs of Disconnected Teams

- Siloed Operations vs Integrated Systems: A Quick Comparison

- Inaccurate Bids and Vanishing Margins

- The Slow Creep of Unchecked Scope

- Painful Gaps in Cash Flow

- The Metrics That Actually Matter for Financial Project Management

- Project Gross Margin

- Budget vs Actual Variance

- Resource Utilization Rate

- How Integrated Workflows Make This Possible

- Your Roadmap to Integrated Operations

- Define Your Destination Clearly

- Select Your Central Hub

- Phase Your Rollout for a Smoother Ride

- How Integrated Systems Create Real-World Wins

- Case Study: Apex Creative Tames Scope Creep

- Case Study: Innovate IT Accelerates Cash Flow

- The Human Side of Change: Getting Your Team on Board

- Addressing the Fears Head-On

- Building a Culture of Growth

- Got Questions? We’ve Got Answers

- What Is a PSA Platform, Really?

- How Does This Help with Resource Planning?

- We’re a Small Firm. What’s the Very First Step?

Boost Profits by Connecting Accounting and Project Management

For far too long, many professional services firms have treated accounting and project management as two completely separate worlds. It’s a common approach, but this siloed thinking is often the root cause of surprise budget overruns and a frustrating disconnect between your project delivery team and financial reality.

The truth is, project success and financial health are completely inseparable. When you bring them together, you unlock the clarity needed to build a more profitable and predictable business.

Why Your Projects Need Financial Clarity

Have you ever finished a project on time, thrilled the client, and hit every milestone, only to find out weeks later that the firm barely broke even—or worse, lost money? It’s a painfully common story, and it points to a critical gap in how many firms operate.

Think of it this way: project management is the engine driving your services forward, but accounting is the dashboard. It shows your speed, your fuel level, and your estimated arrival time. Without that connected dashboard, you’re flying blind, just hoping you have enough fuel to reach your destination profitably.

This guide is for anyone who feels like their projects are running in a financial black box. We’re going to pull back the curtain and show you how merging these two functions creates the clarity you need to shift from reactive problem-solving to proactive, data-driven leadership.

The Growing Need for Efficiency

The professional services industry is more competitive than ever. Just look at the global accounting services market—it’s projected to hit a value of roughly $644–$661 billion by 2025. This growth is fueled by increasing regulatory complexity and a massive demand for high-value advisory work.

So, what does that mean for you? It means the pressure is on to operate with ruthless efficiency to protect your margins and stay ahead.

This competitive environment makes a unified approach to accounting and project management non-negotiable for a few key reasons:

- Smarter Decision-Making: When project managers can see the real-time financial impact of their choices, they make better calls on resource allocation, scope changes, and timelines.

- Accurate Bidding: Tying past project performance data directly to new proposals means you can bid with confidence, knowing your numbers are both competitive and profitable from day one.

- Faster Cash Flow: Automating time and expense tracking straight into your invoicing workflow kills the delays that plague manual processes. You get paid faster. It’s as simple as that.

The core idea is simple: Every task, every hour, and every expense on a project has a direct financial consequence. When your teams can see that connection clearly, they stop managing just tasks and start managing profitability.

This is where the right tools make all the difference. A system that brings project data and financial data together creates a single source of truth for your entire operation. Platforms designed for this are often called Professional Services Automation (PSA) software. If you want to dig deeper, you can learn more about what PSA software is and how it helps firms connect the dots.

This integration isn’t just a “nice-to-have” anymore. It’s the foundational step toward building a more resilient, predictable, and profitable business.

The Real Costs of Disconnected Teams

When your project and finance teams operate in separate worlds, the gap isn’t just an organizational quirk; it’s a costly problem hiding in plain sight. This disconnect creates a painful lag between what happens on a project and when the financial team actually sees the impact. The result? Nasty surprises that quietly eat away at your firm’s profitability.

Project managers are rightly focused on hitting deadlines and keeping clients happy. But without immediate financial feedback, they’re often forced to make critical decisions in the dark. Meanwhile, your accountants are stuck analyzing financial data that’s weeks—or even months—old. By that point, it’s far too late to steer a struggling project back on track.

It’s like trying to navigate a ship using a map that’s a month out of date. You’re already in treacherous waters by the time you realize you’re off course.

Let’s unpack the specific symptoms of this disconnect. Think of them not as isolated incidents, but as systemic failures that directly hammer your bottom line.

To illustrate the stark difference between siloed and unified operations, consider this comparison:

Siloed Operations vs Integrated Systems: A Quick Comparison

| Area of Operation | Siloed Approach (The Problem) | Integrated Approach (The Solution) |

|---|---|---|

| Bidding & Proposals | Based on guesswork and outdated data, leading to low or nonexistent margins. | Informed by real historical data, ensuring profitable bids from the start. |

| Scope Management | Scope creep goes unchecked; “small favors” erode profitability without anyone noticing. | PMs have real-time budget data to push back on scope creep with confidence. |

| Cash Flow | Delayed timesheets, manual reconciliation, and late invoicing create cash flow gaps. | Automated time capture and invoicing mean faster payments and healthier cash flow. |

| Project Profitability | Profitability is a mystery until weeks after the project closes, if it’s ever known at all. | Real-time dashboards show project gross margin and other key metrics instantly. |

| Decision Making | PMs make calls without financial context; finance reports on history, not the present. | Everyone works from the same live data, enabling proactive, informed decisions. |

As you can see, the consequences of disconnected systems aren’t minor inconveniences—they represent fundamental business risks that a unified approach can solve.

Inaccurate Bids and Vanishing Margins

One of the first places the damage shows up is in the proposal stage. Without a clear line of sight into historical data—how long tasks actually take and what they really cost—your bids are based more on hope than reality. You might win the work, but you’ve unknowingly set the project up to be unprofitable from day one.

Imagine a creative agency estimating a website redesign will take 150 hours. Because their accounting and project management systems don’t talk, they’re blind to the fact that similar past projects averaged 210 hours. They win the bid, but their profit margin is gone before the kickoff meeting even starts.

The Slow Creep of Unchecked Scope

Scope creep is a silent profit killer. It often starts with a small, “quick favor” for a client and slowly mushrooms, stretching the project’s boundaries without any corresponding budget increase. When project teams don’t have real-time visibility into how those extra tasks are burning through the budget, they can’t push back with hard data.

For example, a project manager might approve an extra round of revisions to keep a client happy, not realizing that the unbilled hours just tanked the project’s gross margin from a healthy 25% down to a razor-thin 5%.

Without an integrated view, these small concessions pile up, turning what should be successful projects into financial drains. This is a classic symptom of the deep divide between accounting and project management.

Painful Gaps in Cash Flow

Perhaps the most immediate and painful symptom is the hit to your cash flow. When you have a disconnected process for tracking time and expenses, slow and cumbersome invoicing is almost inevitable.

Here’s how that familiar, frustrating cycle usually plays out:

- Delayed Timesheets: Team members scramble at the end of the month to submit hours, often forgetting key details.

- Manual Reconciliation: The finance team spends days chasing down missing information and manually matching expenses to the right project codes.

- Late Invoices: All that manual effort means invoices go out weeks later than they should.

- Slow Payments: And of course, the clock on the client’s payment terms doesn’t even start until they receive that late invoice.

This entire sequence unnecessarily stretches your firm’s days sales outstanding (DSO), creating cash flow crunches that strain everything from payroll to vendor payments. By bringing these functions together, you can automate most of this workflow, making sure invoices are sent promptly and accurately the moment work is ready to be billed.

The Metrics That Actually Matter for Financial Project Management

To get your project delivery and finance teams on the same page, you need a common language. That language is data. By focusing on a few critical metrics, you can empower your project managers to think like business owners, making calls that protect both client happiness and your bottom line.

These aren’t your typical PM metrics like task completion rates. We’re talking about key performance indicators (KPIs) that draw a straight line from project activities to financial results. Let’s dig into the numbers that provide this kind of clarity.

Project Gross Margin

If there’s one number that defines success for a professional services firm, it’s Project Gross Margin. This tells you exactly how profitable a project is before factoring in your firm’s general overhead. It’s the purest measure of a project’s financial performance.

The math is wonderfully simple:

(Total Billed Revenue - Direct Project Costs) / Total Billed Revenue = Project Gross Margin

Direct costs are everything you spend specifically on that project—think employee salaries for hours worked, contractor fees, or project-specific software. A healthy gross margin means every project is actively contributing to the firm’s overall financial health, not just keeping people busy.

Budget vs Actual Variance

Think of this metric as your friendly early-warning system. Budget vs Actual Variance tracks the gap between what you planned to spend and what you’ve really spent at any point in time. Nipping a small variance in the bud is how you prevent a full-blown budget crisis down the line.

Picture a marketing agency running a four-month campaign. Two weeks in, they spot a 15% budget overrun in their “Actuals” column. Because they have that real-time data, the PM can jump in immediately. Maybe a junior team member is taking longer than planned on a task. They can step in with extra training or reassign the work, steering the ship back on course before that 15% hiccup snowballs into a 50% catastrophe by the final month.

This is the power of connecting accounting and project management—it turns historical reporting into an active, in-the-moment management tool. To really get a grip on your numbers, you need a single, clear view of your financial performance metrics for projects.

Resource Utilization Rate

Your team’s time is your most valuable asset, and you can’t get it back once it’s gone. The Resource Utilization Rate measures how much of your team’s available time is spent on billable client work. A low rate might mean you have too many people on the bench. On the flip side, an extremely high rate—say, consistently over 90%—is often a major red flag for burnout.

Tracking utilization is key for:

- Accurate Forecasting: Know your real capacity before you promise new work to clients.

- Team Health: Spot overworked employees before they disengage or, worse, quit.

- Profitability Insights: See which roles or team members are driving the most revenue for the business.

Keeping an eye on this metric ensures you’re using your talent effectively without running them into the ground.

How Integrated Workflows Make This Possible

These metrics don’t just appear out of thin air. They’re the output of integrated workflows where data flows effortlessly from one part of the business to another, creating a single source of truth.

Think about a standard time and expense workflow. In a disconnected setup, it’s a slow, painful process riddled with friction. But when integrated, it becomes a well-oiled machine for financial clarity.

- Capture on the Go: An engineer logs hours and snaps a photo of a receipt for materials, all from their phone. The system instantly links that time and expense to the right project and task.

- See It Now: The “Actuals” on the project dashboard update immediately. The project manager sees the budget impact in seconds, not at the end of the month when it’s too late.

- Invoice Without the Headache: When it’s time to bill, the finance team isn’t hunting down timesheets or re-keying data. They just generate an accurate invoice based on data that’s already been approved.

- Recognize Revenue Correctly: Because the work is documented and tied to specific milestones, revenue can be recognized in line with accounting standards like ASC 606. This gives you a true picture of your financial performance as it happens.

This kind of automated flow doesn’t just save a ton of time. It slashes errors, speeds up your cash flow, and delivers the reliable data you need to calculate the metrics that truly drive your business forward.

Your Roadmap to Integrated Operations

Deciding to unify your systems is a huge step. But the path forward can feel… well, a bit overwhelming. Where do you even begin?

The trick is to stop thinking of this as one massive software upgrade. Instead, treat it like a strategic business initiative, broken down into manageable phases. This roadmap will guide you from the initial diagnosis right through to successful adoption.

Your journey starts with an honest look at your current operations. Don’t just list your software; map out your real-world workflows and pinpoint where the most acute pain is. Is it the chaotic time tracking that leads to endless corrections every month? Or maybe it’s those inconsistent project quotes that burn through your margins before the work even starts?

Getting specific here is everything. Go chat with your project managers, your finance team, and the people on the ground delivering the work. Their day-to-day frustrations will paint a crystal-clear picture of what needs fixing most urgently.

Define Your Destination Clearly

Once you’ve mapped out the problems, you need to define what success actually looks like. Vague goals like “improve efficiency” aren’t going to cut it here. You need specific, measurable outcomes that will act as your North Star through the whole implementation.

For example, are you trying to slash your billing cycle by 30%? Or is the main goal to boost the average project gross margin by 10% within six months? Maybe you just need to hit 95% accuracy in your project forecasting.

These clear objectives do two critical things for you:

- They force you to choose the right tools and configure them for a specific purpose.

- They give you a concrete benchmark to measure your return on investment down the track.

Select Your Central Hub

With your pain points and goals clearly defined, you can start evaluating the technology that will become your operational core. For most professional services firms, this central hub is a Professional Services Automation (PSA) platform.

Think of a PSA as the connector—the single source of truth that bridges the gap between your CRM, project plans, timesheets, and accounting software. This unification is the technical backbone that makes real-time insights possible, turning the abstract idea of integrated accounting and project management into a functional reality. A well-built system allows for flexible financial integration and delegation, which is absolutely key to molding the software to your unique workflows, not the other way around.

Phase Your Rollout for a Smoother Ride

Trying to change everything for everyone all at once is a recipe for pure chaos. A phased rollout is a much smarter, friendlier approach. It minimizes disruption and helps you build momentum.

Start small. Pick a single pilot project or one enthusiastic team to be your guinea pigs.

This approach lets you iron out any kinks in a controlled environment, get real-world feedback, and—most importantly—create a success story you can share with the rest of the firm. Once that pilot team starts raving about faster reporting or painless expense claims, their experience becomes your best marketing tool for getting everyone else on board.

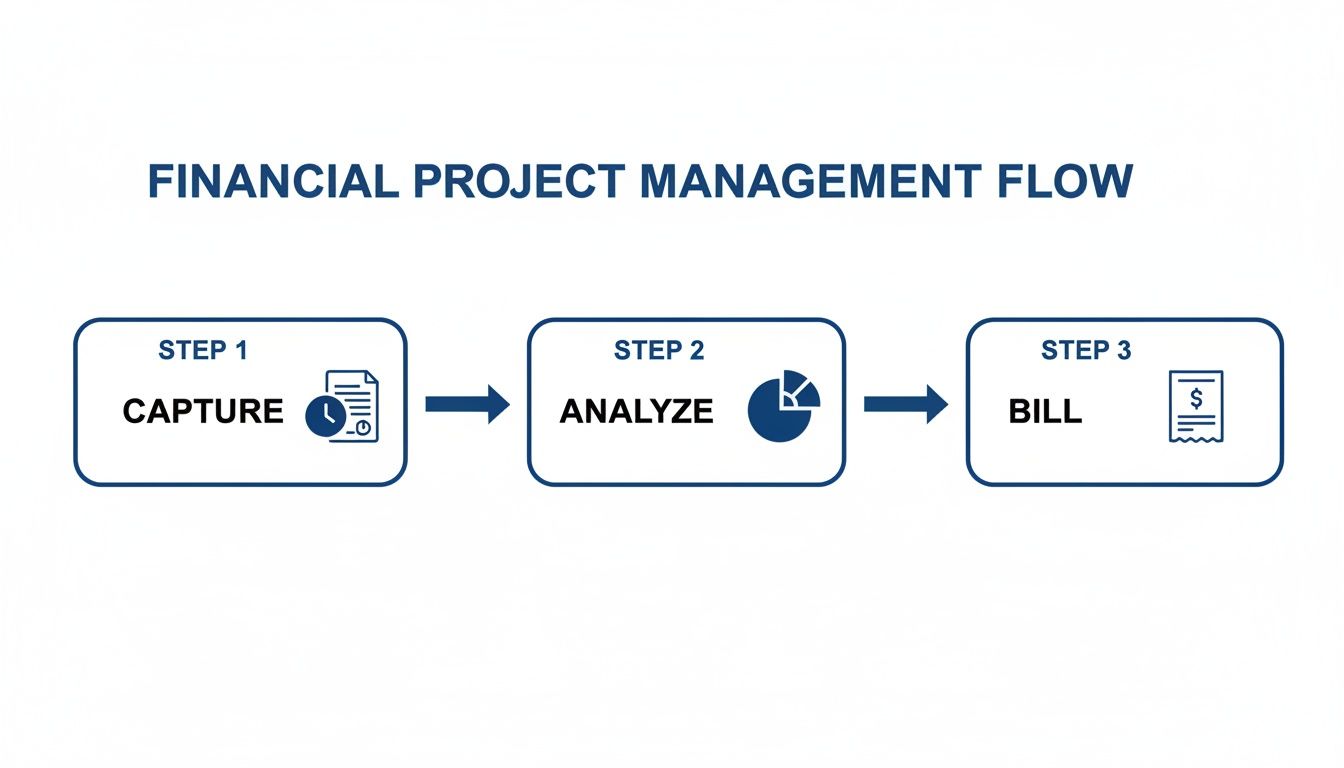

The end goal is a simple, frictionless flow for financial project management: capture work, analyze profitability, and bill the client. It really should be that easy.

This visual shows just how elegantly each step should feed into the next. You’re transforming raw data from timesheets and expenses into actionable financial insights and, ultimately, cash in the bank.

Remember: This is more than a software update; it’s a fundamental shift in how your business operates. You’re moving from siloed teams to a single, connected business engine.

The payoff for making this shift is huge. Firms with tightly integrated systems see a massive impact on their growth. In fact, some studies have shown that firms with highly integrated cloud systems report revenue growth as high as 78–87%. This isn’t just about making life easier; it’s about building a more profitable and resilient firm.

How Integrated Systems Create Real-World Wins

Theory is one thing, but seeing the results in action makes all the difference. Let’s move past the concepts and look at the real wins that happen when you properly integrate your accounting and project management.

These aren’t hypothetical scenarios. They’re realistic examples of how connecting your data can completely change a firm’s trajectory and profitability.

We’ll dig into two all-too-common challenges that professional services firms wrestle with and see how an integrated approach provides a clear, powerful solution.

Case Study: Apex Creative Tames Scope Creep

First up, let’s talk about ‘Apex Creative,’ a sharp marketing agency that was fantastic at delivering client work but was constantly hemorrhaging profit. Their biggest enemy? Scope creep.

Little client requests—an extra graphic here, another round of copy edits there—were slowly but surely killing their margins. Project by project, the profit was just evaporating.

The problem was a classic disconnect. Project managers, focused on keeping clients happy, would approve these “small” additions without seeing the immediate financial damage. It wasn’t until weeks later, when the accounting team finally reconciled everything, that the true cost became clear. The project was often barely profitable, if it broke even at all.

Their solution was to adopt an integrated system that tied their proposals directly to their project plans. It completely changed the game for them.

- Proposals Became Project Blueprints: Every line item in a signed proposal automatically generated a budgeted task in their project management tool. No more guesswork.

- Real-Time Budget Tracking: As the team logged hours against these specific tasks, a live “budget vs. actual” dashboard gave the PMs a constant, up-to-the-minute view.

- Data-Backed Conversations: The next time a client asked for an extra deliverable, the PM could instantly see there was no budget for it. Instead of an awkward pause, they could confidently say, “We’d love to do that for you! It’s outside the original scope, but here’s exactly what it will cost and how it will affect the timeline.”

This shift transformed their client conversations from awkward and defensive to transparent and professional. It wasn’t about saying “no” but about clearly showing the financial reality of the request.

This real-time visibility gave Apex Creative the control they’d been missing. They stopped giving away free work, and their projects became consistently profitable.

Case Study: Innovate IT Accelerates Cash Flow

Next, consider ‘Innovate IT,’ a growing IT consulting firm whose success was being choked by a painfully slow invoicing process. Their growth was great, but their cash flow was terrible. The team was drowning in manual, error-prone admin work that delayed payments and created constant financial stress.

Their billing cycle was a mess. Consultants submitted timesheets at the end of the month, often with incomplete details. The finance team would then spend days chasing information, manually compiling invoices, and finally sending them out—often 45 days or more after the work was done.

To fix this, Innovate IT automated its time and expense process within a unified platform. The impact was immediate and dramatic.

- Instant Time Capture: Consultants started logging time and expenses daily through a mobile app, linking every single entry to the correct project and milestone.

- Automated Invoice Generation: With accurate data flowing in daily, the system could generate a detailed, client-ready invoice the moment a project milestone was completed.

- Dramatically Reduced Billing Cycle: The time from work completion to invoice submission was slashed from 45 days down to just 5.

This automation didn’t just cure administrative headaches; it fundamentally repaired the firm’s financial stability. With cash coming in weeks earlier, Innovate IT could finally invest in hiring, new tools, and business development—fueling their growth instead of being held back by it.

The Human Side of Change: Getting Your Team on Board

Let’s be honest: a new piece of software is only as good as the team that actually uses it. Rolling out an integrated system for accounting and project management isn’t just a technical puzzle; it’s a human one. Your success hinges entirely on getting genuine buy-in from the people whose day-to-day work you’re about to change.

Change can be uncomfortable, and your team is going to have some perfectly valid concerns. It’s your job to get out in front of them, listen, and reframe the conversation from one about loss to one about opportunity.

Addressing the Fears Head-On

Two big anxieties almost always pop up during this kind of shift. The first usually comes from your project managers, who might see real-time budget tracking as a new form of micromanagement. The quiet fear is that every decision will be second-guessed and their autonomy will evaporate.

The second worry often comes from the finance and admin teams. When they hear a word like “automation,” what they might really be hearing is that a new system is coming to make their jobs obsolete.

The key is to shift the narrative. This isn’t about watching over people’s shoulders or replacing them with software. It’s about giving everyone better tools to do more meaningful, high-impact work.

To get ahead of these fears, you have to anchor your communication in the “why.” You need to show your teams how this change actually makes them more strategic, more valuable, and better at their jobs.

Here are a few ways to start earning that buy-in:

- Empowerment, Not Oversight: Frame budget visibility as a tool that gives PMs the data they need to protect their projects and make profitable decisions with confidence. They’re not being watched; they’re being made the true financial owners of their projects.

- Highlight the Strategic Shift: Explain that automating tedious work like manual data entry frees up the finance team for higher-value contributions—things like financial analysis and strategic advice that actually steer the business.

- Invest in Great Training: Don’t just show them which buttons to click. Provide real, comprehensive training that connects the dots and demonstrates how the new workflows make their jobs less about admin and more about impact.

Building a Culture of Growth

This isn’t just a software swap; it’s a chance to redefine roles and open up new career paths. You’re upgrading your team’s capabilities and, in turn, their value to the firm.

For project managers, this is an evolution from being task managers to becoming genuine business leaders. With financial data right at their fingertips, they can manage client relationships with more authority, negotiate scope changes from a position of strength, and see a direct line from their decisions to the firm’s bottom line. Success is no longer just about being on time; it’s about being profitable.

For your finance team, the change is just as profound. The entire accounting profession is in the middle of a massive transformation. The U.S. is staring down 136,400 accounting job openings each year through 2034, driven by a wave of retirements and a desperate need for new skills. Firms are already struggling to find people who are savvy with data analytics and cloud platforms, making it critical for today’s accountants to adapt. You can learn more about the skills shaping the future of accounting in this deep dive.

By leaning into an integrated system, your finance team gets the tools to meet this new reality head-on. They shift from being historical record-keepers to forward-looking strategic partners. They spend less time chasing down timesheets and more time analyzing project profitability trends, spotting risks before they become problems, and giving leadership the insights needed to make smart, proactive decisions. It’s not just a new process—it’s a new, more vital role in the business.

Got Questions? We’ve Got Answers

You’re not alone if you still have a few things you’re wondering about. Bringing your firm’s accounting and project management together is a big shift, so let’s tackle some of the most common questions we hear.

What Is a PSA Platform, Really?

Think of a Professional Services Automation (PSA) platform as the central nervous system for your entire firm. It’s one piece of software designed to connect all the critical parts of your business that usually live in their own separate worlds.

Instead of one tool for sales (your CRM), another for project tasks, and a third for tracking time and sending invoices, a PSA brings it all under one roof. This creates a single source of truth. The real magic is that it kills the need for mind-numbing manual data entry between systems and gives you a crystal-clear view of a project’s entire life, from the first conversation to the final paid invoice.

How Does This Help with Resource Planning?

Good resource planning comes down to two things: visibility and data. Integration is what delivers both. Without it, you’re basically just guessing who’s free, who’s swamped, and for how long.

When your systems are actually talking to each other, you can:

- See Availability in Real-Time: Project managers can instantly view team capacity based on current and future projects, putting an end to accidental overbooking.

- Forecast with Confidence: By looking at solid data from past projects, you can predict how much time future work will really take, which leads to much smarter staffing decisions.

- Maximize Billable Work: It becomes easy to spot underutilized team members and get them onto paying projects, boosting your firm’s revenue.

Ultimately, integration turns resource planning from a reactive scheduling nightmare into a proactive, strategic advantage.

We’re a Small Firm. What’s the Very First Step?

For a small firm, the best thing you can do is map out your current process. Seriously. Don’t even think about buying software yet. Just grab a whiteboard and trace a project’s journey from the initial client call all the way to the money hitting your bank account.

Pinpoint every handoff, every spreadsheet, and every point of friction. Where does information always get lost? What part of the process always causes delays? This simple exercise gives you an honest picture of your biggest pain points, ensuring you invest in a solution that solves your actual problems, not just the ones you think you have.

Ready to stop juggling spreadsheets and start running your firm from a single source of truth?

Drum unifies your proposals, projects, time tracking, and invoicing so you can focus on delivering great work and improving your profitability.

Start your free 14-day trial and discover a better way to run your studio.