- What Is Project Management and Accounting?

- Unifying Operations and Finance

- A Look at the Core Components

- The Strategic Benefits of Integrating Your Projects and Finances

- Uncover True Project Profitability

- A Real-World Example in Action

- Make Smarter Decisions for the Future

- What to Look For in Modern Project Accounting Software

- Project Budgeting and Forecasting

- Seamless Time and Expense Tracking

- Resource Management and Scheduling

- Real-Time Dashboards and Reporting

- How Project Accounting Drives Success in Different Industries

- Marketing Agency Juggling Client Campaigns

- Construction Firm Managing Complex Builds

- Software Development Firm Using Agile Methods

- Your Practical Roadmap to a Successful Rollout

- Step 1: Define Your Goals Upfront

- Step 2: Choose Software That Fits Your Workflow

- Step 3: Run a Pilot Project

- Step 4: Train Your Team and Document Everything

- Common Questions About Project Management and Accounting

- What Is the Main Difference Between General and Project Accounting?

- Can Small Businesses Benefit from Project Management Accounting?

- How Do You Choose the Right Project Accounting Software?

Ever found yourself at the end of a project, looking at the numbers and wondering, how did we go over budget again? It’s a common story, and honestly, a frustrating one. The good news is, there’s a better way. Project management and accounting is all about preventing that unwelcome surprise by weaving financial oversight directly into the fabric of the project itself. It’s a shift from looking at the numbers in the rearview mirror to using them to steer the project toward profitability in real-time.

This approach ensures projects don’t just hit their deadlines; they smash their financial goals, too. Let’s explore how.

What Is Project Management and Accounting?

Think of it like building a house. Traditionally, you have the project manager—the architect—who plans every phase and directs the crew. Then you have the accountant, somewhere else entirely, tallying up the costs for lumber, labor, and permits after the money has already been spent.

In that old-school setup, the architect might approve a beautiful but expensive design change, completely unaware that it will blow the budget. The bad news doesn’t surface until weeks later when the accountant runs the numbers. Sound familiar?

Project management and accounting puts the architect and the financial planner in the same room, working from the same blueprint. It’s a system where every decision—from hiring a contractor to ordering more materials—is immediately reflected in the project’s financial health.

Unifying Operations and Finance

This isn’t just about tracking expenses after they happen. It’s a dynamic, friendly way to keep a finger on the project’s financial pulse as it beats. It connects the what and how of a project directly with the how much. This unified view empowers your team to make smart, data-driven decisions on the fly, stopping budget overruns before they start and protecting your company’s bottom line.

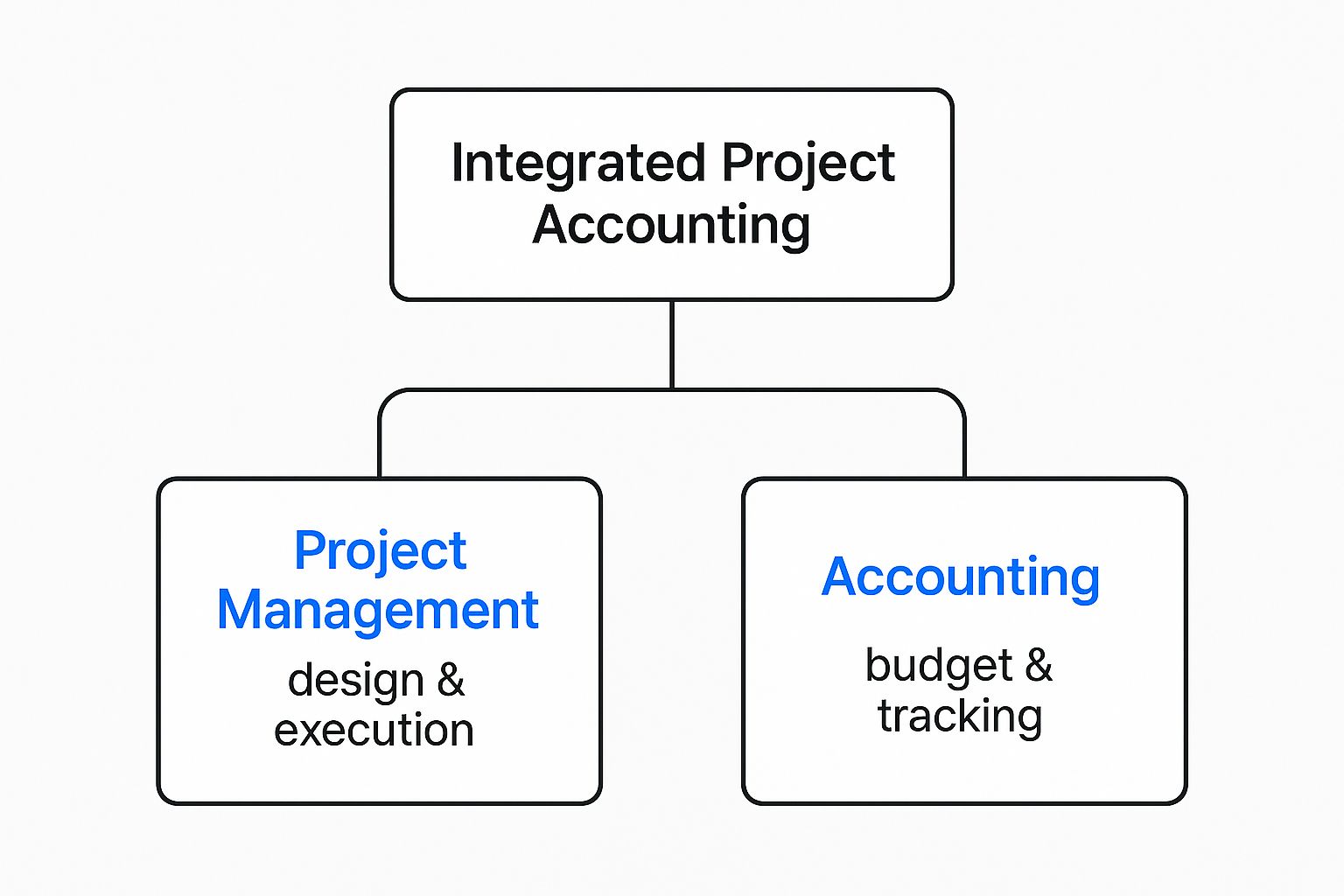

As this graphic shows, integrated project accounting brings together the two distinct worlds of project execution and financial tracking.

The big takeaway here is that operational progress and financial performance aren’t separate issues. They’re two sides of the same coin, constantly influencing each other throughout a project’s life.

This strategy is quickly becoming a must-have for modern businesses. By 2025, it’s expected that 82% of companies will be using work and project management software to drive efficiency, and that absolutely includes smarter financial management. The push for more connected workflows and dead-accurate reporting is fueling this trend.

A Look at the Core Components

So, what does this look like day-to-day? It’s really about a few key pieces working together to give you a complete picture of project health:

- Real-Time Budget Tracking: Imagine your designer logs three hours on a client’s logo. You instantly see that time and its cost reflected in the project’s budget. No more waiting for month-end reports.

- Accurate Costing: Pinpoint the exact cost of labor, materials, and overhead and tie it directly to specific project tasks. Know precisely what that new feature cost to build.

- Profitability Analysis: Move beyond just looking at revenue versus expenses. Understand the true profit margin of every single project, at any given moment.

- Informed Forecasting: Use live financial data to make scarily accurate predictions about final costs and completion dates. For example, if you’re 20% through the timeline but have spent 40% of the budget, you can course-correct immediately.

By connecting every single task to a financial outcome, project management and accounting turns dry financial data from a history lesson into a powerful strategic tool for project success.

This entire philosophy is a cornerstone of professional services automation (PSA) platforms, which are built from the ground up to manage the entire client engagement lifecycle. If you want to dive deeper, you might be interested in our guide on what is PSA software and how these systems work. Ultimately, it’s about making sure every hour worked and every dollar spent is a clear, measurable step toward your financial goals.

The Strategic Benefits of Integrating Your Projects and Finances

Connecting how you run your projects with how you manage your money isn’t just a small tweak for efficiency—it’s a massive strategic advantage. When your project data and financial data live in separate worlds, you’re essentially flying blind. You end up making crucial decisions based on information that’s outdated or just plain incomplete.

Bringing them together gives you a live, accurate view of your business’s health. You get crystal-clear financial visibility, letting you check a project’s financial pulse at any moment. Imagine spotting a budget leak or scope creep the instant it happens, not weeks later during a painful month-end review. This is the difference between proactive course correction and reactive damage control.

Uncover True Project Profitability

Without a unified system, figuring out how profitable a project really is becomes a messy, manual slog filled with guesswork. Sure, you might know the total revenue and the big-ticket expenses, but what about all the smaller, hidden costs that add up? Think about unbilled hours, last-minute revisions, or small software subscriptions.

Integrated project management and accounting systems are designed to catch every single billable hour and every expense right when it happens. You can see your profitability in real-time, not just weeks after an invoice finally gets paid. For any service business, where time is literally money, this isn’t just nice to have—it’s essential.

A study by the Project Management Institute (PMI) found that organizations with mature project management practices waste 21 times less money than their less mature counterparts, largely due to better financial visibility and control.

This level of detail takes your financial analysis from a fuzzy, high-level overview to a sharp, project-by-project breakdown. Suddenly, you can see which clients, services, and project types are the real engines driving your growth.

A Real-World Example in Action

I once worked with a growing creative agency that was constantly wrestling with profitability. They did incredible work and their clients were thrilled, but their margins were razor-thin. They had a gut feeling they were over-servicing clients—giving away free hours and endless revisions—but they had no hard data to back it up.

After they adopted an integrated system, the problem jumped right off the screen. Their real-time dashboards showed that one of their largest accounts was consistently burning through 30% more hours than were budgeted in their fixed-fee contract. All that extra work was getting done, but none of it was ever being billed.

Armed with this data, they were able to have a transparent, productive conversation with the client. They adjusted the scope of work and renegotiated the contract. The result? Within a single quarter, their firm-wide profitability shot up by 15%. They simply closed the gap between the work they did and the work they got paid for.

Make Smarter Decisions for the Future

The payoff of a unified system goes way beyond your current projects. By collecting precise historical data on costs, timelines, and resource allocation, you build an invaluable knowledge base for all future work. This gives you a few killer advantages:

- Sharper Forecasting and Bidding: Instead of relying on gut feelings, you can build proposals and bids based on actual data from similar past projects. This helps you win more work while fiercely protecting your margins.

- Streamlined Billing and Invoicing: Invoicing can be automated based on project milestones or tracked time, which cuts out manual data entry, slashes errors, and gets cash in the door much faster. It’s a game-changer for your cash flow.

- Optimized Resource Allocation: You can instantly see who is swamped and who has capacity. This lets you staff projects more effectively, prevent burnout, and make sure you always have the right people on the right tasks.

Ultimately, integrating your project management and accounting is more than an operational upgrade. It’s a fundamental shift in how you run your business, moving you from a world of guesswork to one of data-driven confidence. This single source of truth empowers you to protect your profits, serve your clients better, and build a more resilient, scalable business.

What to Look For in Modern Project Accounting Software

If you’re serious about making integrated project management and accounting a reality, you need the right tools. Modern software isn’t just a digital shoebox for receipts; it’s an active partner in your project’s financial success. Think of it as the central nervous system connecting every action to a financial outcome, giving you the power to steer your projects toward profit.

But with so many options out there, what features actually matter? Let’s cut through the noise and break down the must-haves that separate a basic tool from one that genuinely drives your business forward. These are the core functions that solve real-world problems, turning messy data into your greatest asset.

Project Budgeting and Forecasting

This is the bedrock of proactive financial planning. A great system lets you build detailed budgets from the ground up, assigning costs for labor, materials, and overhead directly to specific project phases or tasks. It’s the difference between guessing and knowing.

For example, you could budget 20 hours for “Phase 1: Design Mockups” and see in real-time as your team’s logged hours eat into that budget. If a project is creeping over budget, you’ll know in week two—not after the project is already in the rearview mirror. This kind of foresight allows you to make adjustments on the fly, manage client expectations, and stay in control.

Seamless Time and Expense Tracking

For any service-based business, time tracking is non-negotiable. Modern software makes this dead simple. Picture a consultant finishing a site visit; they can log their hours and snap a photo of their lunch receipt right from their phone. Done.

That data doesn’t just sit in a void—it instantly updates the project’s budget. This simple act of automation kills manual data entry, slashes human error, and ensures every minute and every dollar is captured and allocated correctly. It creates a direct, unbroken line from the work being done to the financial reports.

Key benefits of integrated tracking include:

- Accurate Billing: Every billable hour gets captured, plugging the revenue leaks that come from unrecorded work.

- Real-Time Cost Allocation: You see the true labor cost of a project as it happens, not weeks later.

- Simplified Reimbursements: Team members submit expenses on the go, which drastically speeds up the approval and payment process.

Resource Management and Scheduling

Knowing who is working on what—and who has the bandwidth to take on more—is vital for keeping the machine running smoothly. Effective resource management features give you a crystal-clear view of your team’s workload. You can see availability, skills, and current assignments all in one place.

This allows you to assign the right people to the right tasks, preventing both burnout from over-allocation and wasted potential from underutilization. By optimizing how your team’s time is spent, you directly boost project efficiency and, ultimately, your bottom line.

The best project accounting software doesn’t just show you the money; it shows you how your most valuable asset—your people’s time—is being converted into revenue.

This functionality is becoming a major focus for businesses. The global project management software market was valued at nearly $11.96 billion in 2021 and is projected to hit $15.06 billion by 2030. This growth is fueled by the fact that 77% of high-performing projects use these tools to better coordinate everything from schedules to finances.

Real-Time Dashboards and Reporting

All this data is useless if you can’t make sense of it. That’s where real-time dashboards and robust reporting features shine. They transform a flood of complex financial and operational data into simple, visual, and actionable insights.

With just a glance, a project manager can check mission-critical metrics:

- Budget vs. Actual: Are we on track with our spending?

- Project Profitability: Is this project actually making money right now?

- Resource Utilization: Is the team’s time being used effectively?

- Milestone Progress: Are we hitting our key deadlines?

These dashboards serve as your project’s command center. But it doesn’t stop there. Strong reporting tools let you dig deeper to understand your overall business health, allowing you to analyze key performance indicators to improve your financial performance across the board. This is what empowers you to make smarter, data-backed decisions for every project and for the future of your company.

How Project Accounting Drives Success in Different Industries

The theory behind joining project management and accounting is great, but what does it actually look like on the ground? The real value clicks when you see how different businesses use these principles to solve their own unique, industry-specific headaches.

From creative agencies to construction sites, a unified approach to projects and finances is a genuine game-changer. Let’s walk through a few real-world scenarios to see this in action and explore how three very different companies turn chaos into clarity and protect their profits.

Marketing Agency Juggling Client Campaigns

First, let’s step inside a buzzing digital marketing agency. They’re running a dozen client campaigns at once, each with its own messy mix of creative hours, ad spend, and media buys. Their success hinges on being both creative and profitable.

-

The Challenge: The agency was bleeding profits. Team members were tracking time loosely, and it was nearly impossible to know if a fixed-fee social media campaign was making money until weeks after it wrapped. Scope creep was a constant battle, with “just one more revision” quietly eating away at margins.

-

The Solution: They switched to an integrated project management and accounting platform. Now, every campaign is set up as a distinct project with a clear budget for hours and external costs. Creatives and account managers started tracking their time directly against specific tasks, and every dollar of ad spend was logged as it happened.

-

The Result: The impact was immediate. Real-time dashboards gave the owners a live P&L for every single campaign. They could instantly spot which accounts were being over-serviced and have proactive conversations with clients about scope. Within six months, the agency boosted its average project profitability by 22% just by capturing all their work and getting a handle on scope creep.

Construction Firm Managing Complex Builds

Now, let’s head over to a large construction site. A firm is managing a massive commercial build with countless moving parts—subcontractors, material orders, equipment rentals, and the ever-present risk of surprise change orders.

-

The Challenge: Cost control was their biggest nightmare. Subcontractor invoices, material receipts, and labor costs were all managed in different systems. This created a huge lag in understanding the project’s true financial health. A single change order could throw the entire budget into chaos, but they wouldn’t know the full financial damage until the end of the month.

-

The Solution: The firm implemented a project accounting system built for their industry. They could now track every single cost—from a subcontractor’s invoice to a shipment of steel beams—and tie it directly to a specific phase of the project budget. When a client requested a change, they could model the cost and timeline impact on the spot before getting approval.

-

The Result: This newfound visibility was a game-changer. Project managers started making daily decisions based on up-to-the-minute financial data, stopping small overages from spiraling out of control. The firm cut budget overruns by an average of 18% on major projects and improved their cash flow by billing for change orders faster and more accurately. This level of financial control is also critical in related fields; you can learn more in our guide on project management for architects.

By connecting every purchase order and timesheet directly to the project plan, the construction firm turned its accounting data from a historical record into a critical tool for on-site decision-making.

Software Development Firm Using Agile Methods

Finally, let’s look at a software development firm that builds custom apps for clients. They work in fast-paced, two-week “sprints,” an agile methodology where priorities can shift in the blink of an eye.

-

The Challenge: Billing for their work was a constant headache. Clients were confused by invoices that didn’t seem to line up with the progress they were seeing. Internally, it was tough to figure out the true cost of developing a specific feature, which made estimating future projects a shot in the dark.

-

The Solution: The firm adopted a system that linked their project management tool directly with their accounting software. They began tracking developer hours against specific features (or “user stories”) within each sprint. This simple change allowed them to connect every minute of work to a tangible piece of client value.

-

The Result: The firm started sending clients detailed invoices that broke down costs by feature and sprint, which dramatically improved transparency and trust. Internally, they built up a rich database of historical cost data, making their project estimates 30% more accurate. They could now confidently tell clients not just if they could build something, but exactly what it would cost—protecting both their relationships and their bottom line.

Your Practical Roadmap to a Successful Rollout

Switching to an integrated system for your project management and accounting can feel like a monster of a task, but it really doesn’t have to be a headache. Armed with a clear plan, you can make a smooth transition that delivers a powerful return. Think of this as your friendly, actionable roadmap for getting it right from day one.

The trick is to see this as more than just a software rollout—it’s a strategic shift for your business. It’s all about giving your team better tools to do their best work, profitably.

Step 1: Define Your Goals Upfront

Before you even glance at a single piece of software, pull your team together and ask one simple question: “What problem are we actually trying to solve?”

The answers you get will become the north star for this entire process.

Are you wrestling with wildly inaccurate project estimates? Is scope creep eating your profits alive? Maybe your invoicing process is so sluggish it’s choking your cash flow? Get specific. Your goals have to be crystal clear and measurable.

- A Bad Goal: “We want to be more efficient.” (Too vague!)

- A Good Goal: “We need to cut the time it takes to get an invoice to a client from five days down to just one.”

- A Good Goal: “We need to slash our unbilled hours by 15% next quarter by getting better at tracking our time.”

Having these well-defined objectives makes choosing the right tools—and measuring your success later—infinitely easier.

Step 2: Choose Software That Fits Your Workflow

Once you know what you need, it’s time to find a solution that bends to your will, not the other way around. Don’t get distracted by a million flashy features you’ll never touch. Zero in on the core functions that solve the real-world problems you identified in step one.

Think about your team’s day-to-day. If your consultants are constantly on the road, a solid mobile app for time and expense tracking isn’t a luxury; it’s a necessity. If you juggle complex, multi-phase projects, you’ll need robust budgeting and forecasting tools.

The best software feels like a natural extension of your team. It smooths out your existing processes instead of forcing you to adopt clunky, awkward new ones. Look for a clean, intuitive interface that your team will actually want to use.

Step 3: Run a Pilot Project

Whatever you do, don’t try to switch your entire company over in one chaotic weekend. That’s a one-way ticket to frustration and mutiny. Instead, start small with a single pilot project.

Think of it as a dress rehearsal. Pick a straightforward, low-risk project and a small, enthusiastic team to take the new system for a test drive. This creates a safe space to iron out the kinks, tweak the settings, and see how the software holds up in a real-world scenario. You’ll get priceless feedback and create a small army of internal champions who can help you train everyone else.

Step 4: Train Your Team and Document Everything

A successful rollout lives and dies by your team’s buy-in. You have to show them how this new system will make their jobs easier, not harder.

- Focus on the “Why”: Start by explaining the goals you set back in step one. When people understand the purpose behind a change, they’re far more likely to get on board.

- Provide Hands-On Training: Run training sessions tailored to specific roles. A project manager needs to master budget reporting, while a designer just needs to know how to track their time quickly and get back to work.

- Create Simple Documentation: Don’t just point them to the software’s generic help articles. Create a simple, one-page guide with screenshots that shows your company’s specific way of doing things. For example, show exactly how to log time against a client project versus an internal admin task.

This proactive approach demystifies the process and gives your team the confidence to embrace the change, turning what could be a daunting transition into a smooth upgrade for the whole business.

Common Questions About Project Management and Accounting

Even when the benefits are crystal clear, jumping into an integrated system for project management and accounting can stir up a few practical questions. It’s a big move for any firm, and it’s smart to get a handle on the finer points before you commit.

Let’s dig into some of the most common questions we hear from businesses weighing up this approach. My goal here is to give you straightforward, no-fluff answers so you can move forward with total confidence.

What Is the Main Difference Between General and Project Accounting?

This is a fantastic question because it cuts right to the chase.

Think of it like using a camera. General accounting is your wide-angle lens. It gives you that big-picture view of your entire company’s financial health over set periods—a month, a quarter, or a year. It tells you if the business as a whole turned a profit.

Project accounting, on the other hand, is like swapping to a powerful zoom lens. It focuses intensely on the financial story of a single project, from kickoff to completion. It meticulously tracks every dollar of cost and revenue tied to that specific engagement, showing you exactly which projects made money, which lost money, and—most importantly—why.

While general accounting is non-negotiable for your overall financial reporting, project accounting delivers the granular insights you need to make sure every single engagement is a financial win.

Can Small Businesses Benefit from Project Management Accounting?

Absolutely. In fact, you could make a strong case that small businesses stand to gain the most.

For a massive corporation, one unprofitable project might just be a blip on the radar. But for a smaller firm with much tighter cash flow, a single money-losing project can be a major, business-threatening blow.

Project accounting provides the financial guardrails that small businesses need to survive, thrive, and grow. It helps you:

- Price Your Work Accurately: When you know the true cost of past projects down to the dollar, you can build proposals for new work that actually protect your margins. No more guesswork.

- Keep Every Job in the Black: Real-time tracking means you can spot budget overruns the moment they happen, not weeks later when it’s too late. This lets you steer every project back onto the right financial track.

- Fuel Your Growth with Better Cash Flow: By invoicing accurately and on time, you smooth out your cash flow, giving you the capital needed to hire, expand, and invest back into the business.

In the past, these kinds of sophisticated tools were often out of reach. But modern, cloud-based software makes powerful project management and accounting affordable and genuinely easy to use, even for tiny teams or solo operators.

For small firms, profitability isn’t some abstract goal—it’s a matter of survival. An integrated system provides the financial guardrails needed to navigate the challenges of growth, turning risky guesswork into data-driven confidence.

How Do You Choose the Right Project Accounting Software?

Trying to find the right software can feel like a huge task, but it really boils down to one thing: find a tool that adapts to your business, not the other way around. It’s easy to get mesmerized by endless feature lists, but you’ll be better served by focusing on a few key areas that will make a real difference in your day-to-day.

First, take a moment to map out your current workflow for estimating, tracking, and invoicing projects. Where are the bottlenecks? What steps are manual, tedious, and prone to human error? The best tool will be the one that smooths out these specific pain points.

Second, look at integrations. Your project management tool can’t live on an island. Check that it connects smoothly with the accounting platform you already rely on, like QuickBooks or Xero. This link is the key to creating a single, reliable source of financial truth for your entire business.

Third, never, ever underestimate the power of a user-friendly design. If your team finds the software clunky, confusing, or just plain ugly, they simply won’t use it consistently. And inconsistent use defeats the entire purpose of having the tool in the first place. Look for a clean, intuitive interface that feels natural from the get-go.

Finally, think about where you’re headed. The solution that works for you today should also be able to support you in two, or even five, years. Choose a platform that can scale with you as your business grows and your projects inevitably become more complex.

Ready to see how a single platform can unify your projects from proposal to payment?

Drum is designed to give professional services firms a simple, powerful operating system to manage projects, track time, and protect profitability.

Start your free 14-day trial and discover a better way to run your business.