- Programme Risk Management: A Friendly Guide to Navigating Complex Projects

- What Programme Risk Management Means for You

- The Real Difference Between Project and Programme Risk

- Why It Matters More Than Ever

- The Four Pillars of the Programme Risk Management Lifecycle

- Pillar 1: Risk Identification

- Pillar 2: Risk Assessment

- Pillar 3: Risk Response

- Pillar 4: Risk Monitoring

- Navigating Modern Global Threats to Your Programme

- From Local Hiccups to Global Headaches

- Building a Resilient Programme in a Volatile World

- Essential Frameworks and Tools for Success

- Choosing Your Guiding Framework

- Comparing Risk Management Frameworks ISO 31000 vs PMI

- The Indispensable Tool: The Risk Register

- Your Practical Risk Register Template

- Filling Out Your Risk Register: An Example

- How to Implement Risk management in Your Agency

- A Real-World Risk Scenario

- From Identification to Action

- Communicating Impact with Clarity

- Driving Confident Decisions

- Common Programme Risk Management Pitfalls to Avoid

- The Set-It-and-Forget-It Mindset

- Unclear Ownership and Poor Communication

- Got Questions? We’ve Got Answers.

- How Do You Get Stakeholders to Actually Care About Risk Management?

- What’s the Real Difference Between an Issue and a Risk?

- How Often Should We Actually Look at the Risk Register?

Programme Risk Management: A Friendly Guide to Navigating Complex Projects

When you’re running a massive, multi-faceted initiative, things go wrong. It’s practically a rule of business! But how you handle what goes wrong—or better yet, what could go wrong—is what separates a successful programme from a spectacular, budget-burning failure. This is where programme risk management comes in, and it’s your secret weapon.

Think of it as the art and science of identifying, assessing, and dealing with risks that threaten a whole group of related projects, what we call a programme. This isn’t about micromanaging tiny risks on a single project; it’s about protecting the massive business goal the entire programme was created to achieve. Consider it your strategic command center for navigating complex, high-stakes initiatives with confidence.

What Programme Risk Management Means for You

Let me put it this way: imagine you’re the admiral of a fleet, not just the captain of a single ship. It’s a helpful way to picture the difference.

A project risk is a rogue wave hitting one of your vessels. It’s a problem, for sure, but it’s contained to that one ship. Programme risk, on the other hand, is the giant storm system bearing down on your entire fleet, threatening the success of the whole mission. Your job as a programme manager is to see the whole weather forecast, not just the wave that’s right in front of you.

This big-picture view is absolutely critical for pulling off large-scale business objectives. It helps you look beyond isolated project hiccups and tackle the systemic threats that could sink the whole endeavor.

The Real Difference Between Project and Programme Risk

It’s easy to get these two mixed up, but the distinction is crucial for anyone in a leadership role. Let’s break it down with a simple analogy.

A project manager sweats the small stuff (which is their job!). They might worry about a key developer calling in sick, delaying a single software feature. That’s a classic project risk. It’s important, but its impact is limited.

A programme manager, however, is looking at the horizon. They’re worried about a new industry regulation that could make the entire software suite non-compliant, torpedoing all the development projects at once. That’s a programme risk—it affects everything.

Here’s a practical example to make it even clearer:

- Project Risk: The design team for a new marketing website is falling behind, which might push the site’s launch back by two weeks. It’s an isolated delay.

- Programme Risk: The entire company-wide rebranding initiative—which includes that new website, plus updated product packaging and a new sales strategy—is threatened because a competitor just launched a suspiciously similar brand concept. This risk hits every single related project and jeopardizes the programme’s ultimate goal of winning more market share.

Why It Matters More Than Ever

Today, businesses are constantly juggling huge, complex programmes. We’re talking digital transformations, global market expansions, and massive supply chain overhauls. Trying to run one of these without a handle on programme-level risks is like trying to cross the ocean in a rowboat without checking for hurricanes. It’s just not a smart move.

Effective programme risk management is the dividing line between successful large-scale initiatives and the ones that become expensive cautionary tales.

It’s not just about dodging bullets. It’s about building a resilient organization that protects its investments, keeps stakeholders confident, and even turns uncertainty into a competitive edge. This proactive, friendly mindset is non-negotiable for modern leaders.

And the market reflects this shift. The global risk management industry is booming, set to grow from US$10.5 billion to a staggering US$23.7 billion by 2028. That’s a compound annual growth rate (CAGR) of 14.13%, proving that more and more leaders are finally getting the memo. You can explore more risk management statistics to see just how big this trend is.

By putting a solid framework in place, you can make sure your most important business objectives stay on track, no matter what storms come your way.

The Four Pillars of the Programme Risk Management Lifecycle

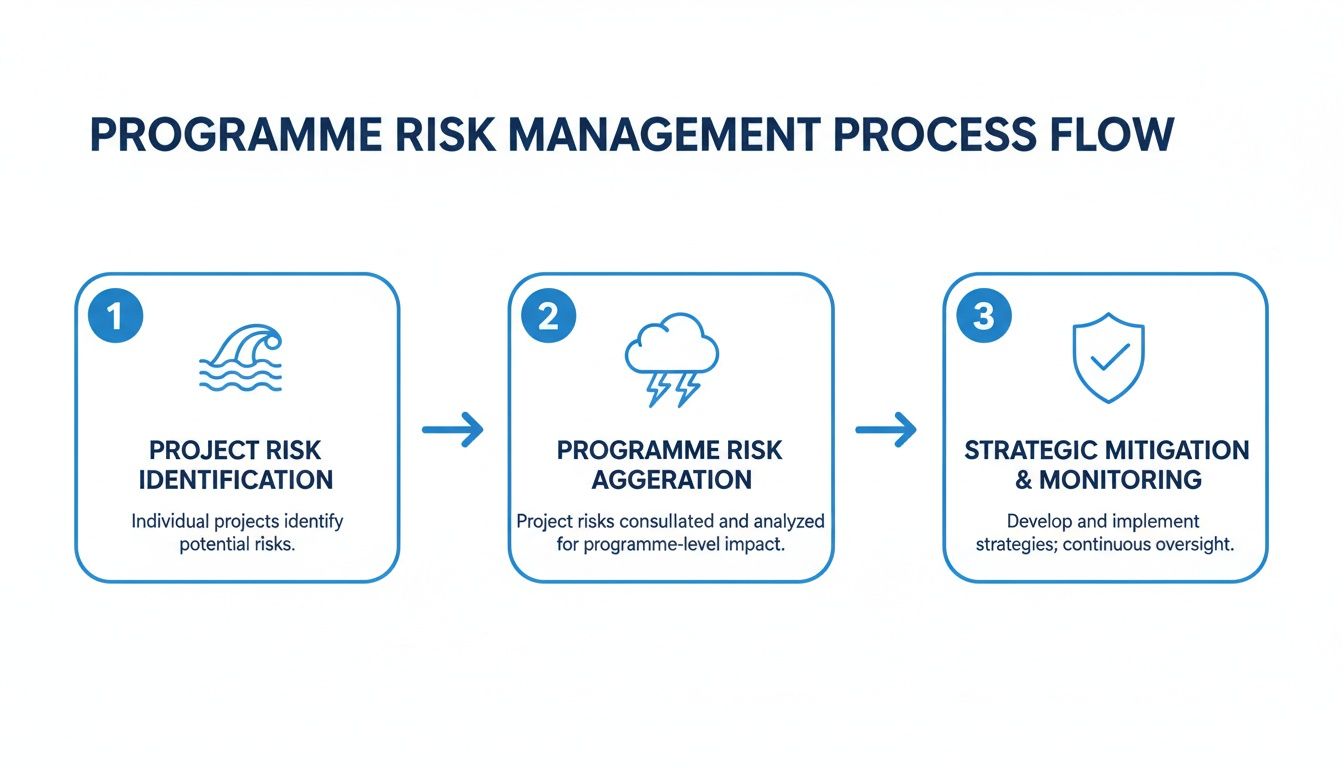

Effective programme risk management isn’t a rigid, one-time task you can just check off a list. It’s much more of a continuous, friendly cycle—a living process that helps your programme adapt and respond to new challenges as they pop up. This cycle is built on four distinct pillars that work together, creating a powerful framework for navigating the inherent uncertainty of large-scale initiatives.

This visual helps illustrate the core idea:

This flow shows why managing threats at the programme level needs a more structured, cyclical approach than just stamping out isolated project fires. By treating risk management as a continuous loop, you can proactively protect the entire initiative from start to finish.

Pillar 1: Risk Identification

Let’s be honest: you can’t manage a risk you don’t know exists. This first pillar is all about proactively uncovering potential threats before they turn into active problems. And this is a team sport, not a solo mission for the programme manager.

The goal here is to cast a wide net and gather a comprehensive list of anything that could derail your programme’s objectives. Collaboration is your greatest asset in this phase.

Great risk identification isn’t about being pessimistic; it’s about being prepared. It transforms “what if” anxiety into a structured plan of action, empowering your team to face challenges head-on.

To get the best results, get your team involved with some tried-and-true techniques:

- Brainstorming Sessions: Pull together project leads, key stakeholders, and team members from different departments. A diverse group will spot risks from multiple angles that one person would almost certainly miss. A friendly, open environment encourages everyone to speak up.

- SWOT Analysis: Take an honest look at the Strengths, Weaknesses, Opportunities, and Threats related to the programme. That “Threats” quadrant is a goldmine for risk identification.

- Expert Interviews: Talk to subject matter experts—both inside and outside your organisation—who have experience with similar large-scale initiatives. Their war stories are invaluable.

For example, imagine a programme to roll out a new company-wide CRM. Your team might identify risks like poor user adoption (“our sales team hates change!”), data migration errors (“what if we lose historical data?”), or integration failures with the existing financial software.

Pillar 2: Risk Assessment

Once you have your list of potential risks, it’s time to figure out which ones actually matter. Not all risks are created equal. Some are minor annoyances, while others are genuine programme-killers. Risk assessment is how you prioritise where to focus your limited time, energy, and resources.

This is where you analyze two key factors for each risk you’ve identified: its probability (how likely is it to happen?) and its impact (how bad will it be if it does?).

A common—and highly effective—tool for this is the probability and impact matrix. This simple grid helps you visually categorise risks, often ranking them on a scale from low to high.

- High-Probability, High-Impact Risks: These are your top priorities, no question. Think of a critical supplier going out of business during a major manufacturing overhaul. This needs your immediate attention.

- Low-Probability, High-Impact Risks: These are the “black swan” events you can’t afford to ignore, like a sudden, major regulatory change. You need a contingency plan, just in case.

- High-Probability, Low-Impact Risks: These are often nuisances you can manage, like minor scope creep on a small project within the programme.

- Low-Probability, Low-Impact Risks: These can often be placed on a watchlist and monitored with less immediate attention.

This step is crucial. It turns a long, overwhelming list of fears into a focused, actionable plan, ensuring you’re not wasting time on minor issues while a major threat looms unaddressed.

Pillar 3: Risk Response

With your risks neatly prioritised, the next step is to decide what you’re going to do about them. A risk response plan outlines the specific actions you’ll take to handle each significant threat. Generally, you have four core strategies to choose from.

- Avoid: Change your plan to eliminate the risk entirely. If a new technology is deemed too unstable for a critical product launch programme, you might choose to stick with the proven, existing tech to avoid the risk of failure.

- Transfer: Shift the financial impact of the risk to a third party. A classic example is buying insurance to cover potential equipment damage or liability on a large-scale construction programme.

- Mitigate: Take concrete steps to reduce the probability or impact of the risk. To mitigate the risk of poor user adoption for that new CRM, you could develop a comprehensive training programme and a phased rollout schedule.

- Accept: For some risks, particularly those with low impact, the most cost-effective solution is simply to do nothing and accept the consequences if they occur. This is a conscious decision, not an oversight.

Pillar 4: Risk Monitoring

Finally, risk management is not a set-it-and-forget-it activity. The fourth pillar, monitoring, is the ongoing process of tracking identified risks, watching for new ones, and checking if your response plans are actually working. Your programme exists in a dynamic world, and your risk landscape will change right along with it.

Regular reviews are essential. This means making risk management a standing item on your programme meeting agendas. You should be constantly asking:

- Have any of our existing risks become more or less likely?

- Has the potential impact of any risk changed?

- Are our response plans still effective, or do they need a rethink?

- Have any new risks emerged that we need to identify and assess?

Using modern tools is key to making this process manageable. While spreadsheets can work for small projects, a dedicated system is a must for complex programmes. Exploring the latest features in modern project management software can show you how integrated platforms help log, track, and report on risks across multiple project streams, keeping everyone in the loop. This continuous vigilance is what keeps a programme resilient from kickoff to completion.

This entire lifecycle is designed to be a continuous loop, ensuring that your programme remains adaptable and resilient. Here’s a quick summary of how the stages fit together.

| Key Stages of the Programme Risk Management Lifecycle | ||

|---|---|---|

| Lifecycle Stage | Core Objective | Example Activities |

| 1. Risk Identification | To proactively uncover all potential threats to programme objectives. | Brainstorming sessions, SWOT analysis, expert interviews, reviewing historical data. |

| 2. Risk Assessment | To analyse and prioritise identified risks based on probability and impact. | Using a probability/impact matrix, qualitative analysis, quantitative financial modeling. |

| 3. Risk Response | To develop and implement strategies for handling prioritised risks. | Creating avoidance plans, transferring risk via contracts, mitigating through action plans, formally accepting low-level risks. |

| 4. Risk Monitoring | To continuously track risks, evaluate response plans, and identify new threats. | Regular risk review meetings, updating the risk register, tracking KPIs, reporting on risk status to stakeholders. |

By embedding this four-pillar cycle into your programme’s rhythm, you move from simply reacting to fires to proactively managing the conditions that could cause them in the first place.

Navigating Modern Global Threats to Your Programme

Your programme doesn’t exist in a bubble. While keeping an eye on internal risks like budget creep and resource shortages is standard practice, the biggest threats often come from way outside your office walls. Real programme risk management demands a strategic, outward-looking mindset that anticipates the major external forces ready to throw a wrench in the works.

These aren’t some distant, abstract problems you see on the news; they are direct, programme-level concerns. Things like geopolitical shifts, shaky supply chains, and sophisticated cyberattacks have become immediate risks that can bring everything to a screeching halt. A single global event can send ripples through every single project under your programme’s umbrella.

From Local Hiccups to Global Headaches

Thinking about global threats can feel a bit overwhelming, but linking them back to your programme is actually pretty straightforward. It’s all about spotting how the wider world can directly mess with your plans. Ignoring these external factors is like planning a cross-country road trip without even glancing at the weather forecast for hurricanes or blizzards.

Let’s look at a few ways this plays out in the real world:

- Geopolitical Instability: Imagine a programme to expand manufacturing into a new country. It could be completely derailed overnight by sudden political unrest or the slap of new trade tariffs, making your materials impossibly expensive.

- Supply Chain Volatility: Your tech hardware rollout depends on components from one specific region. A natural disaster or a factory shutdown there could trigger months of delays, putting the whole initiative on life support. This happened to countless companies during the pandemic.

- Cybersecurity Threats: A digital transformation programme aimed at centralizing customer data suddenly becomes a massive, glowing target for a ransomware attack. A single breach could not only stop the programme cold but also inflict huge reputational and financial damage on the entire company.

These examples make it crystal clear: modern programme risk management has to include a global perspective. Your plans need to be resilient and flexible enough to weather these kinds of storms.

Building a Resilient Programme in a Volatile World

So, how do you even begin to prepare for risks that feel so far out of your control? It starts by baking external monitoring right into your risk management lifecycle. You need to be actively scanning the horizon for potential threats and building out contingency plans before they land on your doorstep.

The goal isn’t to predict the future with 100% accuracy. It’s to build a programme so robust and flexible that it can absorb a shock, adapt its course, and keep moving toward its strategic goals without collapsing.

This proactive stance is more critical now than ever. A recent analysis polling over 900 global experts flagged state-based armed conflict as the top immediate risk for 2025—a factor that has a profound impact on supply chains and international infrastructure projects. Just acknowledging high-level threats like this is the first step toward building a plan that’s genuinely resilient. You can dig into the complete findings in the World Economic Forum’s Global Risks Report 2025.

By broadening your view, you transform your programme from a fragile plan that’s just hoping for the best into a durable strategy that’s prepared for reality. This foresight is what will keep your programme on track, no matter what’s happening in the wider world.

Essential Frameworks and Tools for Success

Moving from theory to action means you need the right frameworks and tools. Solid programme risk management isn’t about making it up as you go; it’s about applying structured, proven methods to bring a bit of order to all that uncertainty.

Think of a framework as your strategic playbook and your tools as the gear that helps you execute the plays.

Two of the most respected playbooks in the world of risk management come from ISO (the International Organization for Standardization) and the Project Management Institute (PMI). While they both aim for the same goal—better risk management—they come at it from different angles.

Choosing Your Guiding Framework

Getting the core idea behind each framework helps you pick the right one for your organisation’s culture and the way your teams actually work.

- ISO 31000 is a set of principles and guidelines. It’s less of a step-by-step manual and more of a flexible, high-level approach. The focus is on weaving risk management into your organisation’s overall governance, strategy, and culture. It’s a great fit for businesses that want to build a holistic, top-down risk-aware mindset.

- The PMI Framework, detailed in resources like the PMBOK® Guide, is much more process-driven. It gives you specific processes, tools, and techniques designed for project and programme environments. This is a fantastic choice for teams that need a more prescriptive, hands-on guide to follow day-to-day.

The best framework is the one your team will actually use. ISO 31000 excels at building a risk-aware culture, while the PMI approach provides a detailed, actionable process for the programme team on the ground.

Neither is universally “better”—it’s all about what fits your team. A high-level comparison can help you see which philosophy aligns better with your needs.

Comparing Risk Management Frameworks ISO 31000 vs PMI

| Aspect | ISO 31000 | PMI Framework |

|---|---|---|

| Focus | Principles-based; integrates risk into overall governance and culture. | Process-based; provides specific steps for projects and programmes. |

| Approach | Strategic and holistic. Aims to embed risk thinking everywhere. | Tactical and procedural. Focuses on risk within the delivery lifecycle. |

| Best For | Organisations seeking to build a comprehensive, top-down risk culture. | Programme teams needing a clear, repeatable process for managing risks. |

| Outcome | A resilient organisation with a unified approach to uncertainty. | A well-managed programme with structured risk controls and responses. |

Ultimately, ISO 31000 helps you build the right mindset across the company, while PMI gives your programme managers the playbook they need to execute on the ground. Many successful organisations actually blend principles from both.

The Indispensable Tool: The Risk Register

No matter which framework you lean on, your most critical hands-on tool will be the risk register. This is so much more than a spreadsheet; it’s the single source of truth for every potential threat to your programme.

This is where you document, track, and assign ownership for every risk you identify. It’s how you transform those vague worries into concrete, manageable action items.

A well-kept risk register is the absolute backbone of your risk management efforts. It ensures nothing gets missed and keeps everyone aligned on what matters most.

Your Practical Risk Register Template

To get you started right away, here’s a simple but powerful structure. The key is to capture the right information, every single time.

Your register should have columns for:

- Risk ID: A unique number for easy tracking (e.g., R-001, R-002).

- Description: A clear, concise summary of the potential risk.

- Impact: How bad will it be if this happens? (e.g., Low, Medium, High).

- Probability: How likely is it to happen? (e.g., Low, Medium, High).

- Risk Score: A calculated value (often Impact x Probability) to help you prioritise.

- Owner: The one person responsible for tracking the risk and leading the response.

- Mitigation Plan: The specific actions we’ll take to reduce the risk’s probability or impact.

- Status: The current state of the risk (e.g., Open, In Progress, Closed).

Filling Out Your Risk Register: An Example

Let’s make this real. Imagine you’re managing a programme to launch a new software product. One risk your team flags is a potential delay from a key third-party API provider your software relies on.

Here’s how you’d log it:

- Risk ID: R-007

- Description: “Delay in delivery of the final billing API from our payment gateway partner, potentially pushing back our subscription launch.”

- Impact: High (This would halt our ability to generate revenue.)

- Probability: Medium (The partner has a good track record but is facing high demand.)

- Risk Score: High (This immediately flags it as a top priority.)

- Owner: Sarah (The Technical Lead)

- Mitigation Plan: “Engage with the partner weekly for status updates. Begin parallel development of a simplified, interim billing solution that can be used at launch if the primary API is not ready.”

- Status: In Progress

Just like that, you have total clarity. Everyone on the programme team knows the risk, its severity, who owns it, and the plan to tackle it. Moving from scattered notes to a central tool like this is a game-changer.

For complex programmes, purpose-built platforms often integrate these registers directly. To see how this works in a live environment, it’s worth exploring what modern consulting project management software can do, bringing risk tracking right into your unified workspace.

How to Implement Risk management in Your Agency

Frameworks and theory are great, but what does solid programme risk management actually look like on a chaotic Tuesday afternoon? Let’s ground this whole concept in a real-world scenario you’ve probably lived through at your agency.

Meet Alex. She’s a programme manager at a digital agency, currently wrangling a massive digital transformation for a major retail client. The programme is a beast, with three tightly connected projects: a new e-commerce platform, a customer loyalty app, and a complete data migration. If one of these dominoes falls, the whole initiative is in serious trouble.

This is the perfect storm for a proper programme risk management process—one that moves beyond scattered spreadsheets into a single, unified system where everyone has visibility.

A Real-World Risk Scenario

One afternoon, Alex gets an email from the client’s head of marketing. He’s running behind on providing the final brand assets and product photography. These assets are needed for both the new website and the loyalty app. This isn’t just a minor project delay; it’s a programme-level risk that threatens two of the three core projects.

In the old days, a red flag like this might have been buried in an email chain or lost in a spreadsheet row that nobody ever looks at. But with a formal process in place, Alex knows exactly what to do.

She immediately jumps into the agency’s central platform to log a new risk. This one simple action makes the issue visible to everyone, from the individual project leads right up to the agency partners. It’s no longer just “Alex’s problem”—it’s an officially tracked programme concern.

From Identification to Action

Logging the risk is just the first step. Alex then uses the system to give the issue context and priority, turning a vague “uh-oh” into something concrete.

- Risk Description: “Key client stakeholder has indicated a delay in delivering final brand assets, impacting both the e-commerce platform and loyalty app projects.”

- Probability: High. The stakeholder has already confirmed the delay is happening.

- Impact: High. Without assets, the development timeline for two critical projects will screech to a halt. This could easily push back the entire programme launch and blow a hole in the client’s projected revenue.

- Risk Owner: Alex assigns herself as the owner, taking clear accountability for seeing it through.

This quick assessment transforms a hazy problem into a quantifiable threat. The system automatically flags it as high-priority, demanding immediate attention. Now, instead of managing by gut feel, Alex has a data-backed reason to escalate.

Communicating Impact with Clarity

With the risk logged and prioritized, Alex’s next job is communication. She can’t just tell her team, “We’re blocked.” She needs to show them the ripple effect to get everyone aligned on a fix.

She generates a quick risk report directly from the tool. This isn’t some dense document; it’s a clear, visual summary of the potential domino effect: a two-week delay in getting assets could cause a four-week slip in the overall launch date, putting the client’s peak season sales goals at risk.

This is the power of a centralized system. It moves the conversation from “We have a problem” to “Here is the specific business impact of this problem, and here is our plan to address it.”

Alex presents this concise report in a quick huddle with her internal leadership and the client. The visual data makes the severity of the situation impossible to ignore. Suddenly, the conversation isn’t about blame; it’s laser-focused on finding a solution, fast.

Driving Confident Decisions

That clear, data-driven report empowers everyone to make smarter decisions. Seeing the direct financial impact, the client stakeholder immediately re-prioritizes his team’s workload to fast-track the asset delivery. Internally, the agency leadership sees the tangible value of a system that connects day-to-day hiccups to the bigger financial picture.

This whole scenario shows the real-world benefit of ditching scattered information for a unified approach. A central system gives you visibility, enforces accountability, and lets you make proactive, confident decisions. It turns programme risk management from a theoretical chore into a powerful tool for protecting your most important client relationships—and your bottom line.

Common Programme Risk Management Pitfalls to Avoid

Even with the best frameworks and tools, a programme risk management strategy can still fall flat. It often comes down to avoiding a few common, surprisingly simple traps that can derail even the most well-intentioned efforts.

Think of this as friendly advice from the trenches—a few hard-won lessons to help you sidestep preventable headaches.

The single biggest mistake? Treating risk management as a one-time, “check-the-box” activity. You can’t just hold a kickoff meeting, fill out a risk register, and then file it away somewhere to gather dust. Your programme is a living thing, and so are its risks.

The Set-It-and-Forget-It Mindset

When you treat your risk register as a static document, you lose all visibility into new and evolving threats. What starts as a minor, low-probability issue one month can quickly snowball into a major concern after a sudden market shift or a change in project scope.

Effective programme risk management is a continuous conversation, not a one-off report. It must be woven into the daily and weekly rhythm of your programme to have any real impact.

Here’s a simple, actionable fix: make risk a standing agenda item in your weekly programme meetings. Just a quick five-minute review of the top three risks keeps them front-and-center, ensuring the team stays vigilant and proactive.

Unclear Ownership and Poor Communication

Another classic pitfall is foggy ownership. When a risk is identified but no single person is assigned to own it, everyone assumes someone else is handling it. This is a direct path to inaction, and the potential problem is left to fester until it blows up into a real crisis.

Equally damaging is poor communication that leaves stakeholders in the dark. If project teams don’t understand the programme-level risks, they can’t help you spot early warning signs. This is especially true as risks become more interconnected. Modern programmes face converging threats where, for example, a supply chain disruption is tied to a cyber event. According to Aon’s 2025 Global Risk Management Survey, over 60% of major markets now rank cyber risk, supply chain issues, and talent shortages as top concerns, highlighting how these areas overlap. You can discover more insights in the full Aon survey.

To avoid these common traps:

- Assign a Single Owner: Every single risk in your register must have one person’s name next to it. No exceptions. This creates crystal-clear accountability.

- Communicate Broadly: Don’t hoard information. Share a simplified view of the top programme risks with all project teams and explain how their work connects to the bigger picture.

- Establish Clear Escalation Paths: Make sure everyone on the ground knows who to talk to and exactly how to raise a red flag when they spot a potential new risk.

Got Questions? We’ve Got Answers.

Even with a great strategy, real-world questions always come up when you start putting programme risk management into action. Let’s tackle a few of the most common ones we hear from teams on the ground to clear up some practical details.

How Do You Get Stakeholders to Actually Care About Risk Management?

This is a great question! First things first, stop calling it a bureaucratic chore. You need to frame it as what it is: a tool for success that protects everyone’s hard work. Don’t just talk about risks; show them. Use simple, powerful visuals like a risk matrix to connect the dots between your process and the things they really care about—budgets, deadlines, and hitting their business goals.

The most effective trick is to make it personal. Pinpoint a specific risk and tie it directly to a stakeholder’s domain. For the finance director, you might show how a shaky supplier could torpedo the programme’s ROI. For the head of sales, you could model how a delay in one feature launch impacts their quarterly targets. This creates a genuine sense of ownership. A great move? Mitigate a small, visible risk on a project and then share that success story. Nothing builds confidence like a quick win.

What’s the Real Difference Between an Issue and a Risk?

This one trips people up all the time, but it’s simple when you think about timing. A risk is a storm cloud on the horizon. It’s a potential problem that might happen in the future. An issue is the storm breaking right over your head—it’s a problem that’s happening right now.

Risk: “Our lead developer is looking a bit burnt out. There’s a chance she might hand in her notice next month, which would derail Phase 2.” Issue: “Our lead developer just resigned. We’re now two weeks behind schedule on Phase 2 before it’s even started.”

Solid programme risk management is all about spotting those storm clouds early and changing course, turning potential disasters into complete non-events.

How Often Should We Actually Look at the Risk Register?

This isn’t a one-size-fits-all answer; it depends entirely on the pace and complexity of your programme. For most typical programmes, a dedicated, deep-dive review of the full risk register once a month is a solid baseline.

If you’re in a fast-and-furious environment or the stakes are incredibly high, you’ll want to tighten that up to a bi-weekly review. But here’s the critical part: your high-priority, “keep you up at night” risks shouldn’t wait for a formal meeting. They should be a standing item in weekly team huddles and daily check-ins. Your risk register should be a living, breathing document, not a dusty report you file away and forget.

Ready to ditch the scattered spreadsheets and bring your risk management into a single source of truth?

Drum gives you the visibility and control to log, track, and report on risks across your entire portfolio, turning uncertainty into your biggest strategic advantage.

Start your free 14-day trial and discover a better way to run your studio.