- How Do You Calculate Overhead for Your Professional Services Firm?

- What Is Overhead and Why Does It Matter?

- The Two Types of Costs

- Quick Guide to Common Overhead Costs

- Why Tracking Overhead Is Crucial

- Calculating Your Firmwide Overhead Rate

- The Standard Formula for Professional Services

- A Practical Example: An Engineering Firm

- Choosing the Right Overhead Allocation Method

- Calculating an Hourly Overhead Rate

- Other Allocation Methods to Consider

- Navigating Overhead for Government Contracts

- Understanding Allowable vs Unallowable Costs

- Adjusting Your Rate for a Government Proposal

- How Modern Tools Simplify Overhead Tracking

- From Manual Data Entry to Automated Insights

- Creating a Single Source of Truth

- Gaining Real-Time Visibility

- Common Questions About Calculating Overhead

- How Often Should I Calculate My Overhead Rate?

- What Are the Biggest Mistakes to Avoid?

- How Does My Overhead Rate Affect Project Pricing?

How Do You Calculate Overhead for Your Professional Services Firm?

Figuring out how to calculate overhead is actually pretty simple on the surface: you just add up all your business’s indirect costs for a specific period and apply them to your projects using a formula.

The real trick, though, is nailing down what actually counts as an overhead expense in the first place. This is where most firms get tangled up, but don’t worry—we’re here to help you sort it all out.

What Is Overhead and Why Does It Matter?

Before we jump into the numbers, let’s get on the same page about what “overhead” really means for a professional services firm. Think of it as all the essential, ongoing expenses that keep your business running but aren’t directly billable to a specific client or project.

These are the costs that keep the lights on and the machine humming behind the scenes. They’re absolutely vital, but they often fly under the radar when you’re head-down in client work.

The Two Types of Costs

Every single expense in your business falls into one of two buckets: direct or indirect. Getting this distinction right is the first critical step toward having any real control over your finances.

-

Direct Costs: These are expenses you can pin directly to a specific project. For a marketing agency, this would be the salary of the graphic designer working on a client’s rebrand or the cost of a software license bought exclusively for that one project.

-

Indirect Costs (Overhead): These are the shared costs that support the entire business. We’re talking about your office rent, the salaries of your administrative team, your marketing budget, and that general liability insurance policy.

A quick way to visualize this is to break down some common expenses.

Quick Guide to Common Overhead Costs

This table shows a simple breakdown of typical indirect (overhead) costs versus direct project costs in a professional services firm. It’s a handy cheat sheet to help you start sorting your own expenses.

| Expense Type | Example | Category |

|---|---|---|

| Salaries | Admin Assistant’s Paycheck | Overhead |

| Salaries | Senior Consultant’s Project Hours | Direct Cost |

| Office Expenses | Rent, Utilities, Coffee Machine | Overhead |

| Software | Project-specific Analytics Tool | Direct Cost |

| Software | Company-wide Subscription to Slack | Overhead |

| Marketing | Google Ads Campaign | Overhead |

| Legal & Accounting | Annual Retainer | Overhead |

Getting these categories right is foundational. If you misclassify a direct cost as overhead (or vice versa), all your downstream calculations will be skewed.

Key Takeaway: You can’t assign your office rent to a single client, but you couldn’t serve any of your clients without it. That’s the essence of an overhead cost—it supports everything you do.

Why Tracking Overhead Is Crucial

So, why all the fuss? Without a firm grip on your overhead, you’re essentially flying blind. You won’t know the true cost of delivering a project, which inevitably leads to underpricing your services and torching your profit margins.

Think about it. If you only price a project based on a consultant’s hourly rate, you’re completely ignoring the hidden costs of their desk, laptop, health insurance, and the marketing dollars it took to land that project in the first place.

Accurate overhead calculation reveals the actual cost of doing business. It’s what empowers you to set profitable rates, bid on projects with confidence, and make financial decisions based on reality, not guesswork.

Effectively managing these costs is a core function of running a services business. A clear understanding of what is PSA software can show you how modern tools are built to automate this entire process. We’ll dig into that a bit more later on.

Calculating Your Firmwide Overhead Rate

Alright, now that you’ve got a handle on what overhead is, let’s get into the brass tacks. Calculating your firmwide overhead rate is probably the single most powerful move you can make to understand your true cost of doing business. The formula itself is simple, but the story it tells about your firm’s financial health is anything but.

What we’re trying to find is a percentage. This number represents how much it costs to support all of your direct, project-related work. For every dollar you spend on billable labor, how much do you have to spend on everything else just to keep the lights on? This rate is your answer.

The Standard Formula for Professional Services

For professional services firms—think consulting, engineering, architecture—the industry-standard method is both straightforward and incredibly effective. The most reliable way to calculate your firmwide overhead rate is to divide your total indirect expenses by your total direct labor costs. As experts at Deltek point out, this approach is the go-to for setting project fees and estimating profitability. You can discover more about this industry-standard calculation on Deltek.com to refine your billing rates.

Here’s the formula:

Firmwide Overhead Rate = Total Indirect Expenses / Total Direct Labor Cost

This method works so well because in a service business, your people are your primary “product.” Their time drives both revenue and costs, which makes direct labor the most logical and stable foundation for allocating your overhead.

A Practical Example: An Engineering Firm

Let’s make this real. Imagine a mid-sized engineering firm, “Innovate Engineers,” is looking at its numbers from the last quarter. Here’s how they’d put the formula into action.

First, they tally up all their indirect costs for the period:

- Administrative Salaries: $75,000

- Office Rent & Utilities: $45,000

- Software Subscriptions (firmwide): $15,000

- Marketing & Business Development: $20,000

- Insurance & Professional Fees: $10,000

- Total Indirect Expenses = $165,000

Next, they calculate their total direct labor cost for that same quarter. This is the sum of salaries for every engineer, designer, and project manager for the time they spent working directly on billable client projects. Let’s say that number is $110,000. Getting this figure right is absolutely vital, which is why robust time tracking and expense software is non-negotiable.

Now, they just plug these numbers into the formula:

Overhead Rate = $165,000 / $110,000 = 1.5

To turn this into a percentage, you just multiply by 100. That gives the firm an overhead rate of 150%.

This means that for every $1.00 Innovate Engineers spends on direct project labor, it costs them an additional $1.50 in overhead just to support that work.

This is a powerful piece of information. It’s the bedrock for setting profitable billing rates and making sure every single project actually contributes to the bottom line.

Choosing the Right Overhead Allocation Method

A single firmwide overhead rate is a fantastic starting point, but let’s be honest—it doesn’t always paint the full picture. What happens when your design department and your engineering team have completely different resource needs? That’s when a more granular approach becomes necessary to really understand where you’re making money.

For most professional services firms, the most logical and popular approach is labor-based allocation. It’s simple and effective. This method ties your indirect costs directly to the effort your team puts in, which makes perfect sense when your people are your product. You’re essentially figuring out how much overhead each billable hour needs to carry to cover its share of the business’s costs.

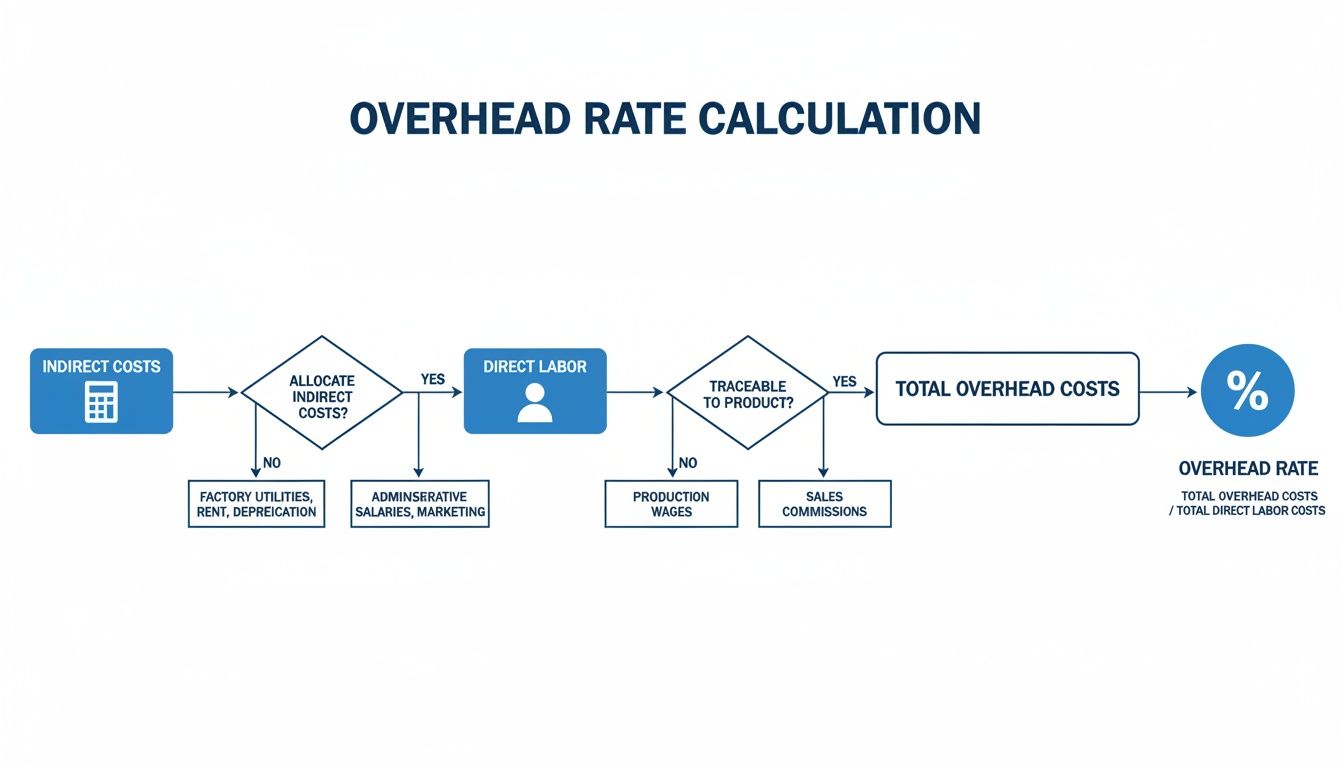

This visual breaks down the relationship between your indirect costs, direct labor, and your final overhead rate.

As the flowchart shows, the core process is about spreading your total indirect costs across your team’s direct labor to land on your final rate.

Calculating an Hourly Overhead Rate

Let’s walk through a practical example from a marketing agency to see this in action. The goal is to figure out an overhead cost per direct labor hour. Once you have that, you can apply it to individual projects for precise job costing.

First, you need two key figures for a set period (like a month):

- Total Indirect Costs: All your non-project expenses—think rent, admin salaries, and software subscriptions.

- Total Direct Billable Hours: The total number of hours your team logged working on actual client projects.

Let’s imagine the agency’s total indirect costs for the month were $50,000. During that same month, their team of designers, copywriters, and strategists logged a combined 2,000 billable hours.

The formula is refreshingly simple:

Hourly Overhead Rate = Total Indirect Costs / Total Direct Billable Hours

Plugging in our numbers: $50,000 / 2,000 hours = $25 per hour.

This $25 per hour is the overhead “load” that has to be added to every single billable hour just to break even. So, if a designer’s direct labor cost is $50 per hour, their fully burdened cost to the agency is actually $75 per hour ($50 + $25). Nailing this number is absolutely critical for setting profitable project prices.

Other Allocation Methods to Consider

While labor-based allocation is king in professional services, it’s worth knowing about other methods that can be useful in specific situations.

- Allocation Based on Revenue: This method allocates overhead based on the revenue each department or project generates. It can be simple, but be careful—it might unfairly penalize high-revenue, low-effort service lines.

- Allocation Based on Square Footage: This one is perfect for allocating facility-related costs (like rent and utilities) if different departments take up vastly different amounts of office space.

Still, the labor-based method remains the cornerstone for consulting, creative, and marketing firms because it rightly assumes that overhead is driven by employee effort. Industry data shows this method is used by a whopping 65% of professional services firms, where overhead rates often average 120-140% of direct labor costs. You can learn more about these common overhead findings to see how your firm stacks up.

This approach also works beautifully with tools like Drum, where time tracking is built into the platform’s DNA, making the whole calculation process seamless.

Navigating Overhead for Government Contracts

Landing a government contract can be a massive win for any architecture, engineering, or consulting (AEC) firm. But it also throws a wrench into how you handle your overhead calculations. If you’re bidding on public projects, you’ll get familiar with the Federal Acquisition Regulation (FAR) very quickly, and it comes with its own very specific rulebook.

Simply put, your standard commercial overhead rate is not the same as your FAR overhead rate. They’re two completely different numbers. The government demands a specific, audited calculation to make sure taxpayer dollars are only covering allowable costs. This means you can’t just send over your internal figures—you have to prepare a compliant rate that can stand up to serious scrutiny.

Understanding Allowable vs Unallowable Costs

The biggest hurdle is figuring out what the government considers a legitimate business expense. The FAR has a long list of costs it deems “unallowable,” and you have to pull every single one of them out of your overhead pool before you can calculate your rate for a government proposal.

Some of the most common unallowable costs include:

- Most advertising and public relations expenses

- Entertainment costs (think client dinners or tickets to a game)

- Interest on loans

- Lobbying expenses

- Bad debt

On the flip side, the government lets you add an expense you probably don’t track in your commercial overhead: Facilities Capital Cost of Money (FCCM). It’s basically an imputed cost that accounts for the capital tied up in your firm’s facilities and equipment.

Key Takeaway: A FAR overhead rate isn’t just a different formula; it’s a whole different mindset for public sector work. Meticulous, compliant accounting isn’t just a good idea—it’s the price of entry.

Adjusting Your Rate for a Government Proposal

Let’s walk through how this plays out for a hypothetical architecture firm, “Apex Designs.”

Apex Designs has a commercial overhead rate of 160% of their direct labor, based on all their indirect costs. Now, they’re bidding on a federal project and need to figure out their FAR rate.

Their first move is to go through their trial balance with a fine-tooth comb, identifying and removing every unallowable cost. For A/E firms, this is a heavy lift. It’s not uncommon for a firm with a 160% overhead to see disallowances around 12%, which would immediately drop their FAR rate to 140.8%. That’s a significant adjustment that directly impacts contract negotiations. You can dive deeper into FAR calculations on dmcpas.com to make sure your firm stays compliant.

After Apex pulls out disallowed costs like marketing parties and interest payments, they then add in their calculated FCCM. They take this newly adjusted indirect cost pool and divide it by the same direct labor base they used before. The result is their official FAR overhead rate—a new, lower percentage that they’ll use in their government proposals and that will eventually be audited for compliance.

How Modern Tools Simplify Overhead Tracking

![]()

Let’s be honest—manually wrestling with spreadsheets to calculate overhead is more than just tedious. It’s a recipe for costly mistakes. This is exactly where modern tools can be a game-changer for your firm, turning a cumbersome quarterly chore into a source of real-time business intelligence.

A purpose-built professional services automation (PSA) platform completely transforms this process. Instead of chasing down timesheets and expense reports at the end of the month, the data collection becomes a natural part of your team’s daily workflow.

From Manual Data Entry to Automated Insights

Imagine your team logging their hours and expenses directly into a system that already understands the difference between a billable project and an internal overhead task. This isn’t just about making life easier; it’s about accuracy from the ground up.

When your consultants, designers, and engineers can tag their time to specific categories—like “Business Development” or “Internal Training”—you eliminate all the guesswork. This creates a clean, reliable dataset from the very beginning. You can learn more about how modern time tracking for professional services can automate this crucial first step.

The key insight here is simple: when data entry is easy and integrated into daily work, the quality of your financial data improves dramatically. That makes every subsequent overhead calculation more accurate.

Creating a Single Source of Truth

The real power emerges when your PSA platform integrates seamlessly with your accounting software, like Xero or QuickBooks. This connection breaks down the walls between your project operations and your financial data, creating a single, authoritative source of truth for the entire business.

When your project management tool and your general ledger are in sync, you can:

- Pull in actual indirect costs automatically, which means no more manual data reconciliation between systems.

- Ensure consistency between the hours your team logs and the direct labor costs recorded in payroll.

- Generate reports that blend operational and financial data, giving you a complete, unvarnished view of project profitability.

This integration means you’re no longer comparing apples and oranges from different spreadsheets. All your data lives in one place, updated in real time.

Key Takeaway: The goal of modern tools isn’t just to make calculations faster. It’s to give you live, trustworthy data so you can stop looking in the rearview mirror and start making proactive decisions that protect your margins.

Gaining Real-Time Visibility

Once your data is centralized and automated, you unlock the ability to monitor your firm’s financial health on demand. Instead of waiting until the end of a quarter to see how your overhead is trending, you can just pull up a dashboard. Anytime.

This real-time visibility is what allows you to be agile.

You can spot if your marketing spend is creeping up unexpectedly or if administrative costs are higher than budgeted for the month. This lets you protect your profit margins and make confident, data-backed decisions without getting bogged down in the busywork of manual calculations.

Common Questions About Calculating Overhead

Alright, we’ve walked through the formulas and the “how-to” of calculating your overhead. That’s the science part. But knowing how to actually use those numbers to make smarter decisions for your firm? That’s the art.

Let’s dig into some of the most common questions we hear from firm owners. My goal here is to give you clear, straight answers so you can handle your firm’s finances with a lot more confidence.

How Often Should I Calculate My Overhead Rate?

Don’t treat this like a once-a-year tax season headache. For a clear, useful picture of your firm’s health, you should be running the numbers at least quarterly. This hits the sweet spot—it’s frequent enough to spot important trends without bogging you down in admin work.

Now, if your business is seasonal or you’re in a rapid growth phase, you might want to tighten that up to a monthly calculation. A monthly check-in is your early warning system. It helps you catch things—like a sudden jump in software subscriptions or a dip in billable hours—before they snowball and wreck your whole quarter.

What Are the Biggest Mistakes to Avoid?

When you’re figuring out your overhead, a few common slip-ups can completely throw off your numbers. Just being aware of them is half the battle.

-

Misclassifying Costs: This is the big one. People constantly mix up direct and indirect costs. For example, logging a software license for a specific project as a general business expense. Doing that makes your overhead rate look higher than it is, and it makes that particular project seem way more profitable than it actually was.

-

Using Outdated Data: Pricing this year’s projects on last year’s numbers is a classic mistake. Costs go up, your team changes, and that old data just isn’t telling you the truth about your business today. Always, always use the most recent and complete data you have.

-

Ignoring Non-Billable Time: It’s easy to forget about tracking essential but non-billable work like business development, internal training, or proposal writing. If you don’t track it, you’ll have a skewed understanding of your team’s real capacity and your true labor costs.

Look, a reliable overhead rate is completely dependent on the quality of the data you feed it. There’s no way around it. Clean, consistent, and current data isn’t just nice to have; it’s non-negotiable.

How Does My Overhead Rate Affect Project Pricing?

Your overhead rate is the crucial bridge between what it costs you to run your business and how you price your services. It’s what turns a simple labor cost into a fully burdened cost—the actual cost of an employee’s time.

Let’s break it down with a practical example. Say you have a consultant whose direct labor cost is $75 per hour, and your firm’s overhead rate is 150% (or 1.5).

- Overhead Cost Per Hour: $75 (Direct Labor) x 1.50 (Overhead Rate) = $112.50

- Fully Burdened Cost: $75 (Direct Labor) + $112.50 (Overhead) = $187.50 per hour

That $187.50 is your break-even point for that consultant. If you bill them out at anything less, you are officially losing money. Knowing this number is everything. It lets you price your projects with a healthy profit margin baked in, so you can bid with confidence, knowing you’re covering not just salaries, but everything it takes to keep the lights on.

Ready to stop wrestling with spreadsheets and get real-time visibility into your firm's overhead and profitability?

Drum unifies your projects, time tracking, and financials into a single source of truth. See how much easier it can be to make confident, data-driven decisions.

Start your free 14-day trial and discover a better way to run your studio.