- A Practical Guide to the Job Costing Sheet

- Why Your Service Firm Needs to Master Job Costing

- From Guesswork to Guaranteed Margins

- The Hidden Costs of Manual Tracking

- The Core Components of a Job Costing Sheet

- Tracking Direct Labor Costs

- Accounting for Direct Materials

- Managing Subcontractor Costs

- Applying Overhead Costs

- Essential Components of a Job Costing Sheet

- Getting the Numbers Right for True Profitability

- Combining Your Direct Expenses

- Applying Your Overhead

- Calculating the Total Job Cost

- Measuring Your Gross Profit Margin

- A Practical Example: A Consulting Engineering Project

- Making Job Costing a Part of Your Daily Workflow

- Connect Your Systems for a Single Source of Truth

- Establish a Cadence for Review and Action

- Using Job Costing Data for Smarter Business Decisions

- Sharpening Your Future Proposals

- Identifying Your Most Profitable Work

- A Design Studio’s Data-Driven Pivot

- Common Job Costing Mistakes We’ve All Made (And How to Avoid Them)

- Inconsistent (or Guesstimated) Time Tracking

- Forgetting About the “Death by a Thousand Cuts” Costs

- Using a Stale Overhead Rate

- Treating Job Costing as an Autopsy

A Practical Guide to the Job Costing Sheet

At its heart, a job costing sheet is a project-specific ledger. It’s where you meticulously track all the direct and indirect costs tied to a job—from your team’s labor and the materials you use, right down to subcontractor fees and a slice of your overhead. Think of it as your project’s financial command center, giving you a live feed of where every single dollar is going.

Why Your Service Firm Needs to Master Job Costing

If you’ve ever watched a project’s budget spiral out of control, you know that sinking feeling. It’s a common pain point for service firms, and it’s not just about losing money on one job. It erodes your team’s confidence, strains client relationships, and makes your next quote feel like a shot in the dark.

The solution is getting a real handle on job costing.

This isn’t about creating another stuffy accounting document. A well-managed job costing sheet is a strategic tool. It turns raw financial data into sharp, actionable intelligence that helps you build a more predictable and profitable business.

From Guesswork to Guaranteed Margins

Without detailed cost tracking, every quote you send is a mix of past experience and a healthy dose of hope. A job costing sheet flips that script, replacing uncertainty with hard data. When you know the true cost of your past projects, you can quote future work with precision, ensuring every new client engagement is set up for success right from day one.

This historical data gives you a clear baseline, so you can account for all the variables. The benefits are immediate:

- More Accurate Quotes: You can build proposals based on actual costs, not just industry averages. This protects your margins before the work even starts.

- Improved Cash Flow: With a clear view of expenses as they happen, you can invoice clients at key milestones much more effectively, keeping cash moving through the business.

- Predictable Profitability: You’ll quickly see which types of projects and clients are your most profitable, allowing you to focus your business development efforts on high-value work.

The Hidden Costs of Manual Tracking

Before digital tools were the norm, old-school manual job costing sheets led to significant errors in as many as 25% of projects, causing average margin losses of 15%. Ouch.

Today, platforms that integrate time tracking and real-time reporting allow firms to monitor project phases with incredible precision. You can finally see exactly where costs balloon, often due to scope creep or unexpected hurdles. We’ve seen firms using detailed digital sheets reduce their cost variances by 28%, which directly boosts cash flow through more timely and accurate invoicing.

A job costing sheet acts as an early warning system. It helps you spot budget overruns as they happen, not after the project is finished and the damage is done. This allows you to have proactive conversations with your team and clients to get things back on track.

Ultimately, mastering your job costing sheet is about taking control. It’s the key to shifting your firm’s operations from reactive problem-solving to proactive, data-driven management. When you bring your project management and accounting together, you create a single source of truth that empowers smarter decisions at every stage of a project.

The Core Components of a Job Costing Sheet

Staring at a blank job costing sheet can feel a lot like assembling furniture without instructions. You’ve got all these different pieces of financial data, but how do they actually fit together to give you a clear picture? Let’s break down the essential components into simple, manageable categories.

The easiest way to think about it is to sort your costs into four main buckets: Direct Labor, Direct Materials, Subcontractors, and Overhead. Once you understand the “why” behind each one, you can build a sheet that genuinely works for your service business.

To make this real, let’s follow a project for a hypothetical creative agency, “PixelPerfect Designs.” They’ve just landed a gig creating a full brand identity and website for a new tech startup. We’ll use their project to see how each cost bucket gets filled.

Tracking Direct Labor Costs

For any service firm—be it an agency, consultancy, or architecture practice—labor is almost always the biggest line item. Direct Labor covers the wages, payroll taxes, and benefits for every team member who puts billable time directly into a specific project. It’s literally the cost of the hands-on work that gets the client their deliverable.

Getting this number right is non-negotiable. It means your team has to track their hours diligently against the correct job or project codes. Guessing who worked on what for how long is a surefire way to kill your profit margins.

Here’s how PixelPerfect Designs tracks this for their startup client:

- Senior Designer: Spends 40 hours on brand strategy and initial logo concepts. At a fully loaded rate of $75/hour, that comes to $3,000 in direct labor.

- Junior Designer: Logs 60 hours building out web page mockups and social media templates. At their rate of $45/hour, that adds another $2,700.

- Web Developer: Puts in 80 hours actually building the website. At a rate of $65/hour, this contributes $5,200 to the job’s labor cost.

Each of these entries is tied directly to the “Startup Brand Project” on their job costing sheet, giving them a running labor total of $10,900. This level of detail lets them spot if the design phase is dragging on longer than they quoted, so they can make adjustments on the fly.

Accounting for Direct Materials

When you hear “materials,” you might picture lumber and nails, but service firms have them too. Direct Materials are any tangible or digital assets you buy specifically for a single project. These are the costs that are easiest to overlook, but they can add up fast.

Just to be clear, we’re not talking about your general office supplies. A direct material is something you wouldn’t have purchased if not for this specific job.

For the PixelPerfect project, their direct materials might look like this:

- Stock Photography: A premium license for images used exclusively on the client’s new website costs them $250.

- Custom Fonts: They purchase a commercial license for a specific font family chosen for the branding, which costs $150.

- Software Plugin: A specialized WordPress plugin is needed for a unique website feature, with a one-time fee of $100.

By itemizing these on their sheet, PixelPerfect ensures these costs are either passed on to the client or, at the very least, factored into their final profit calculation. The total direct material cost for this job lands at $500.

Capturing even small direct costs is crucial. A forgotten $100 plugin license on ten different projects throughout the year adds up to a $1,000 loss in profit that you can’t explain.

Managing Subcontractor Costs

Very few firms can do everything in-house. Subcontractors are the external experts you bring in to handle specialized parts of a project, like a freelance copywriter, a commercial photographer, or a specialized engineering consultant.

It’s vital to track these costs separately from your internal labor. Subcontractors have different payment terms and markups, and if you don’t manage them properly, you can run into serious cash flow headaches.

On their startup branding project, PixelPerfect decides to bring in some outside help:

- Freelance Copywriter: They hire a writer to craft all the website content for a flat project fee of $2,000.

- SEO Specialist: An external consultant is paid $1,500 to handle keyword research and on-page optimization.

These expenses go straight into the subcontractor section of the job costing sheet. This keeps them clearly separate from employee labor and shows exactly how much of the budget is flowing to external partners. The total subcontractor cost for this job is $3,500.

Applying Overhead Costs

This is the one that trips up so many firms. Overhead Costs are all the indirect expenses needed to run your business that you can’t pin on a single project. We’re talking about things like office rent, utilities, general software subscriptions (like your accounting platform), and administrative salaries.

Since these costs don’t belong to any one job, you have to allocate a fair portion of them to every project. This makes sure each job is carrying its weight in keeping the lights on. The most common way to do this is by calculating a predetermined overhead rate.

Let’s say PixelPerfect figured out their annual overhead is $120,000, and they expect their team to work a total of 6,000 direct labor hours this year.

Overhead Rate Calculation: $120,000 (Total Overhead) / 6,000 (Total Labor Hours) = $20 per direct labor hour

Now, they can apply this rate to the startup project. The team has logged a total of 180 direct labor hours so far (40 + 60 + 80).

Applied Overhead: 180 hours * $20/hour = $3,600

This $3,600 gets added to their job costing sheet as the project’s share of the agency’s operational costs. If they skipped this step, they’d be flying blind and drastically overestimating their profitability.

To help you get started, here’s a quick breakdown of what goes where.

Essential Components of a Job Costing Sheet

This table gives you a quick reference for the key categories and what to include in each. We’ll use our marketing agency example to make it concrete.

| Cost Category | What to Include | Example (Marketing Agency Campaign) |

|---|---|---|

| Direct Labor | Employee wages, payroll taxes, and benefits for time spent directly on the project. | 40 hours from a Senior Designer at $75/hr = $3,000. 60 hours from a Junior Designer at $45/hr = $2,700. |

| Direct Materials | Tangible or digital assets purchased specifically for the project. | $250 for stock photo licenses. $150 for a commercial font license. |

| Subcontractors | Fees paid to external freelancers, consultants, or companies for specialized work. | $2,000 flat fee for a freelance copywriter. $1,500 for an SEO consultant. |

| Overhead | A portion of the business’s indirect operating costs (rent, utilities, admin salaries) allocated to the project. | A rate of $20/hr applied to 180 total project hours = $3,600. |

By meticulously tracking these four core components, PixelPerfect has a crystal-clear financial picture of their project before it’s even finished. That’s the real power of a well-structured job costing sheet.

Getting the Numbers Right for True Profitability

A job costing sheet really comes to life the moment you start crunching the numbers. This is where all your hard work tracking labor, materials, and overhead pays off, revealing exactly how profitable a project actually is. And don’t worry, the math isn’t complicated. With the right formulas, it becomes a clear, repeatable process.

Let’s break down how to turn that raw data into financial insight you can actually use.

Combining Your Direct Expenses

First things first, you need to tally up every cost you can point directly at the project. This gives you your Total Direct Cost, and it’s a simple sum of the three core pieces we’ve already covered: labor, materials, and any subcontractors you brought on board.

Total Direct Costs = Direct Labor + Direct Materials + Subcontractor Costs

This formula gives you the baseline cost of just doing the work, before factoring in what it costs to keep the lights on. For a service business, this is your “cost of goods sold.” Nailing this number is the foundation of accurate job costing.

Applying Your Overhead

Next up are the indirect costs—all the essentials like rent, software subscriptions, and admin salaries that don’t belong to a single project. This is where you apply your predetermined Overhead Rate. If you’re still working on locking that number down, our guide on how to calculate your overhead rate is a great place to get a detailed walkthrough.

Applying this rate ensures every project pulls its own weight and contributes fairly to the company’s running costs.

Applied Overhead = Total Project Direct Labor Hours x Predetermined Overhead Rate

Once you have this figure, you’re ready to see the full picture.

Calculating the Total Job Cost

With your direct costs totaled and your overhead applied, figuring out the Total Job Cost is a breeze. This number represents every single cent your firm spent to deliver the project, from billable hours right down to a slice of the electricity bill.

Total Job Cost = Total Direct Costs + Applied Overhead

This is probably the most critical number on your sheet. It’s your breakeven point. If the final invoice you send the client is less than this, you’ve lost money on the job. Period.

Measuring Your Gross Profit Margin

Finally, it’s time to measure how successful the project truly was. The Gross Profit Margin tells you what percentage of the revenue is pure profit after you’ve covered every single cost. For any professional services firm, a healthy margin is everything.

Gross Profit Margin (%) = [(Total Revenue - Total Job Cost) / Total Revenue] x 100

This percentage isn’t just a number; it’s a powerful KPI. When you start tracking it across all your projects, you’ll quickly see which types of clients or services are your real money-makers, which can—and should—inform your entire business strategy.

A Practical Example: A Consulting Engineering Project

Let’s put this into practice with a real-world scenario. Imagine an engineering firm, let’s call them “StructureFirst,” takes on a structural analysis project.

Here’s a snapshot of their job costing sheet:

- Direct Labor:

- Senior Engineer: 50 hours @ $90/hr = $4,500

- Junior Engineer: 80 hours @ $55/hr = $4,400

- Total Direct Labor = $8,900

- Direct Materials:

- Project-specific software license: $750

- Large-format blueprint printing: $250

- Total Direct Materials = $1,000

- Subcontractors:

- Geotechnical consultant’s fee: $3,000

- Total Subcontractor Costs = $3,000

Now, they calculate their Total Direct Costs: $8,900 (Labor) + $1,000 (Materials) + $3,000 (Subcontractors) = $12,900

Next, StructureFirst applies its overhead. Their predetermined rate is $25 per direct labor hour. With 130 total direct labor hours on the project (50 + 80), the calculation is simple.

Applied Overhead Calculation: 130 hours x $25/hour = $3,250

With that, they can pin down their Total Job Cost: $12,900 (Direct Costs) + $3,250 (Overhead) = $16,150

This is their magic number—the breakeven point. The firm charged the client a flat fee of $22,000. So, how did they do?

Gross Profit Margin Calculation: ($22,000 - $16,150) / $22,000 = 0.2659 0.2659 x 100 = 26.6% Gross Profit Margin

By running these numbers, StructureFirst knows with absolute certainty that the project was profitable, and by exactly how much. This is the kind of clarity that lets you make business decisions with real confidence.

The beauty of modern professional services automation platforms is that they do all of this heavy lifting for you. When your team tracks time and expenses in a system like Drum, the platform automatically tallies direct costs, applies your overhead rate, and gives you real-time profitability reports. This gets rid of manual spreadsheets and turns your job costing sheet from a historical record into a live dashboard for your project’s financial health.

Making Job Costing a Part of Your Daily Workflow

A job costing sheet is a fantastic tool, but it’s completely useless if it just gathers dust until a project is over. That’s a huge missed opportunity. To get the real value, you have to work it into your firm’s day-to-day operations.

When you do this, your job costing sheet stops being a static, historical report and becomes a live dashboard for your project’s financial health. It’s all about creating a smooth flow of information where data is captured as it happens, not chased down weeks after the fact.

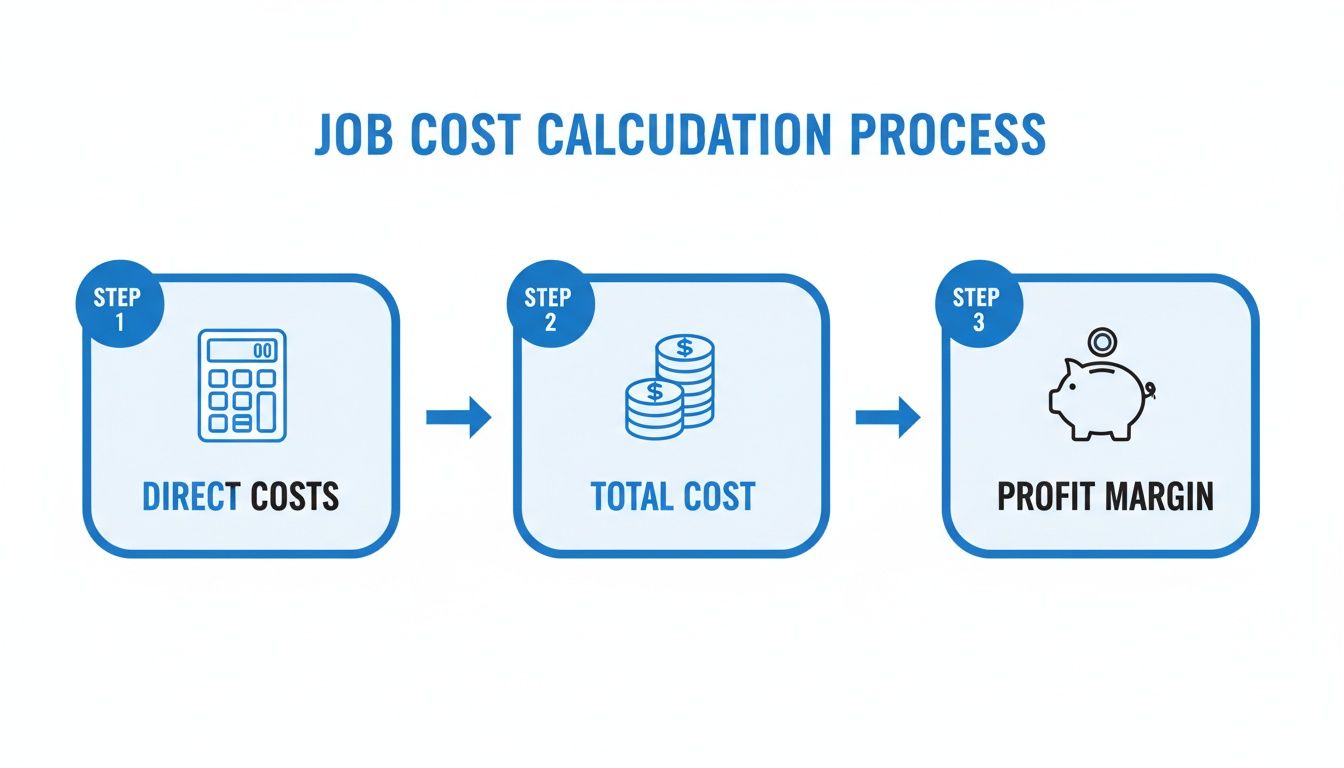

This process flow shows how direct costs feed into the total job cost, which is ultimately what determines your profit margin on any given project.

This visual makes it crystal clear: profitability isn’t an accident. It’s the direct result of meticulously tracking every single cost that goes into a job.

Connect Your Systems for a Single Source of Truth

The absolute best way to make job costing a daily habit is through integration. Let’s be honest—manually typing in timesheet data or scanning expense receipts is a soul-crushing task, and it’s practically begging for errors. By connecting your job costing system with the other tools your team already uses, you create a single source of truth where data flows automatically.

Think about it: your team is already using these tools every day. The goal is to grab the data from those activities without making them do any extra work.

- Time Tracking Software: When your team logs hours against a project, those hours should instantly show up in the direct labor section of your job costing sheet. No more guessing games or manual data entry.

- Expense Management Systems: A project manager submits an expense for a client-specific software license? That cost should automatically land under the right job’s direct materials category.

- Invoicing and Accounting Platforms: Linking your job costing sheet to your accounting software means that as you send invoices, the revenue is tracked directly against the project’s costs. This gives you a live, up-to-the-minute look at profitability.

For firms that want to bring all these functions under one roof, integrated platforms that combine time tracking and expense software can be a total game-changer. It creates a seamless operational flow from the first hour tracked to the final invoice.

Establish a Cadence for Review and Action

Automation gets the data into the system, but it’s the consistent review that turns that data into smarter business decisions. Don’t wait until a project is wrapped up to see how you did. You need to establish a regular rhythm for checking in on project financials.

A job costing sheet is your early warning system. Reviewing it weekly allows you to spot budget overruns and scope creep while you still have time to do something about them—not after the project is complete and the damage is done.

Set up a simple, repeatable process for your team:

- Daily Time Entry: This has to be a non-negotiable rule. All time must be logged by the end of each day. It’s a simple habit that improves accuracy by over 90% compared to logging time weekly or bi-weekly.

- Weekly Project Check-ins: Every Friday, project managers should sit down and review their job costing sheets. Are the labor hours tracking against the budget? Have any surprise material costs popped up?

- Monthly Financial Review: Leadership needs to look at the profitability of all active projects once a month. This high-level view helps you spot trends, like figuring out which types of projects are consistently your most profitable.

By making job costing a continuous loop of data collection and review, you empower your team to manage projects proactively. You’re no longer just looking at history; you’re actively shaping the financial success of your firm, one project at a time.

Using Job Costing Data for Smarter Business Decisions

Once a project wraps up, your job costing sheet isn’t done. In fact, it’s just getting started on its most important job: turning into a goldmine of business intelligence. This historical data is your secret weapon for making smarter, more strategic decisions that will genuinely shape the future of your firm.

By taking the time to analyze your completed sheets, you can finally move beyond knowing if a project was profitable. You can start to understand the much more important question of why. This is where you find the trends and insights that actually drive growth.

Sharpening Your Future Proposals

The most immediate payoff from analyzing past job costs? Quoting future work with incredible accuracy. Think of every completed job costing sheet as a data-rich case study, revealing what it truly takes to deliver a specific type of project.

Instead of relying on gut feelings or vague industry averages, you can build new proposals on a foundation of hard evidence. The real learning happens when you compare what you estimated against what actually happened.

- Estimated vs. Actual Labor: Did the design phase run 20% longer than you planned? That single data point sparks a crucial conversation. Was it scope creep? An inefficient internal process? Or just an overly optimistic estimate? Answering that question is how you quote labor more accurately next time.

- Material Cost Variances: Did the price of a key software license jump between your quote and the project kickoff? Tracking this variance helps you build smarter contingencies for fluctuating costs into future proposals.

By consistently refining your estimates based on actuals, you’re protecting your margins before a new project even begins. It’s a data-driven approach that builds confidence, both for your team and your clients.

Identifying Your Most Profitable Work

Do you really know which types of clients or projects are your biggest money-makers? I’ve seen many firm owners who are surprised by the answer when they finally dig into the numbers. The high-profile, complex projects you love might actually have razor-thin margins, while smaller, more routine jobs are quietly padding your bottom line.

A collection of completed job costing sheets lets you slice and dice your work to analyze profitability by:

- Client Type: Are your tech startup clients more profitable than your established corporate accounts?

- Project Type: Do brand identity projects consistently yield higher margins than website development gigs?

- Service Line: Is your consulting arm outperforming your implementation services?

Answering these questions helps you focus your sales and marketing efforts where they’ll have the biggest impact. When you know your winners, you can double down on what works and strategically adjust your pricing for those less profitable engagements.

Your job costing sheet isn’t just a historical record; it’s a forward-looking tool for growth. The data from past projects is the clearest roadmap you have for building a more profitable future.

A Design Studio’s Data-Driven Pivot

Here’s a practical example I’ve seen play out. A boutique design studio was convinced their large, custom website builds were their most valuable service. But after analyzing a year’s worth of job costing sheets, they uncovered a startling trend.

These big projects consistently suffered from scope creep, leading to major labor overruns that absolutely crushed their margins.

In stark contrast, their smaller “brand-in-a-box” packages for new businesses were consistently hitting a 40% profit margin. The data was undeniable.

Armed with this insight, the studio shifted its entire focus. They refined their package offering, invested more in marketing it, and adjusted their pricing model for custom builds to better account for potential overruns. Within six months, their overall firm profitability shot up by 15%.

This kind of strategic pivot was only possible because they treated their job costing data as a decision-making tool, not just an accounting exercise. That’s the real power you unlock with a well-maintained job costing sheet.

Common Job Costing Mistakes We’ve All Made (And How to Avoid Them)

Even the most buttoned-up job costing sheet can fall flat if you stumble into a few common traps. I’ve seen these issues trip up even the most seasoned firms, so let’s walk through them. Steering clear of these will make sure your numbers are accurate, reliable, and actually useful for making decisions.

The goal is to get your job costing right from the jump. The good news? Most of these mistakes are pretty easy to prevent with a bit of foresight and the right systems in place.

Inconsistent (or Guesstimated) Time Tracking

This is, hands down, the biggest point of failure. When your team logs hours sporadically—or worse, tries to remember everything at 4:55 PM on a Friday—your direct labor costs become a work of fiction. Since labor is almost always the biggest expense for a service firm, even tiny inaccuracies can completely torpedo your profitability analysis.

That weekly scramble to fill out timesheets can lead to errors of 10-15%. That’s more than enough to completely wipe out a project’s profit margin.

My two cents: Make daily time entry a non-negotiable team habit. The best way I’ve seen to enforce this is by using integrated time-tracking software that lets people log hours against specific projects in just a few clicks. Make it easy, and they’ll do it.

Forgetting About the “Death by a Thousand Cuts” Costs

It’s easy to remember the big subcontractor invoice or that major software license. But what about all the little things? A $50 stock photo license here, a $75 project-specific plugin there—these costs add up way faster than you think.

When they aren’t logged against a specific job, they just get tossed into the general overhead bucket. This bloats your indirect costs and makes individual projects look more profitable than they really are. Over a year, this can lead to thousands of dollars in “mystery” expenses that are quietly eating away at your bottom line.

Using a Stale Overhead Rate

Applying the wrong overhead rate is like using the wrong conversion rate on a currency exchange—the final number will be meaningless, no matter how precise your other inputs are. So many firms make the mistake of setting their rate once and then just forgetting about it. But business costs are always in flux; rent goes up, you add new software subscriptions, and admin salaries increase.

If your overhead rate is too low, you’ll consistently underestimate job costs and pat yourself on the back for profits that don’t exist. If it’s too high, you might overprice your services and wonder why you’re losing competitive bids. You absolutely have to review and recalculate your overhead rate at least once a year.

Treating Job Costing as an Autopsy

This one drives me nuts. The final mistake is treating the job costing sheet as a historical document, something you only look at after the project is wrapped up. Doing this completely misses its value as a real-time management tool.

Waiting until the end just means you’re performing a post-mortem on what went wrong. Regular check-ins—I recommend weekly—let you spot budget overruns and scope creep as they happen. This proactive approach gives you a chance to course-correct with your team or have a tough but necessary conversation with your client while there’s still time to get the project’s financials back on track.

Managing all these moving parts is exactly where a dedicated system shines.

Drum automatically pulls in data from time tracking and expenses, applies your overhead correctly, and gives you real-time dashboards that make those regular reviews painless.

Ready to see how a unified platform can help you sidestep these common mistakes and actually drive profitability? Start your free 14-day trial today.