- A Practical Guide to Project Accounting Management

- What Is Project Accounting Management

- The Core Difference From General Accounting

- Why It Matters for Your Business

- The Four Pillars of Project Accounting

- Pillar 1: Project Budgeting and Forecasting

- Pillar 2: Time and Expense Tracking

- Pillar 3: Revenue Recognition

- Pillar 4: Job Costing and Allocation

- Tracking Your Project Financial Health With KPIs

- The Most Important Project Accounting KPIs

- Turning Data Into Decisions

- Essential Project Accounting KPIs at a Glance

- Getting a Handle on Common Project Accounting Headaches

- The Problem of Inaccurate Time Tracking

- Scope Creep: The Silent Profit Killer

- Forecasting Final Costs Accurately

- Choosing The Right Project Accounting Software

- Must-Have Features For Project-Based Businesses

- The Growing Role Of AI And Cloud Technology

- A Checklist For Evaluating Your Options

- Feature Checklist for Project Accounting Software

- A Few Common Questions

- What’s the Very First Step for a Small Business?

- How Is This Different From My Regular Accounting?

- Can This Really Help with Resource Planning?

- How Often Should I Be Looking at Project Financials?

A Practical Guide to Project Accounting Management

Hey there! Let’s talk about the secret weapon for keeping your projects in the black: project accounting management. It’s all about tracking every single dollar—from the initial budget right through to the final invoice. This isn’t your typical company-wide accounting; it’s a laser-focused look at the profitability of individual projects, making sure each one is pulling its weight and boosting your bottom line.

What Is Project Accounting Management

Imagine trying to navigate a ship across the ocean using only a giant world map. That map is like your general accounting—it gives you the big picture but is pretty useless for dodging specific icebergs or navigating tricky currents. Project accounting management, on the other hand, is your dedicated GPS, compass, and radar, all rolled into one. It delivers real-time financial data for each project, from the day it kicks off to the day it’s complete.

This specialized discipline is the financial co-pilot for any service-based business, whether you’re a creative agency, a consulting firm, or an engineering practice. For companies like these, profit isn’t made from selling physical products; it’s made by brilliantly managing time, resources, and project milestones.

The Core Difference From General Accounting

While your traditional accounting gives you a rear-view mirror look at the company’s overall financial health, project accounting provides a live, forward-looking dashboard for every single client engagement. It’s built to answer the critical questions that general accounting simply can’t touch:

- Is this specific project actually profitable? It drills down past the company-wide revenue numbers to tell you if a particular engagement is making or losing money. For instance, an architecture firm might find that while residential projects look good on paper, their commercial projects consistently deliver a 15% higher profit margin.

- Are we sticking to the budget? It constantly measures actual spending against what you planned, flagging potential overruns long before they spiral out of control.

- How are our people and resources being used? It helps you see exactly where billable hours and expenses are going, ensuring your team’s hard work is directly tied to revenue.

This level of detail is non-negotiable. Without it, a firm might look profitable on the surface while bleeding cash on a few badly managed projects. It’s a classic pitfall that can quietly sink a company’s financial stability over time.

By treating each project as its own mini-business with a unique profit and loss statement, project accounting management empowers you to make smarter, more informed decisions. It transforms financial data from a historical record into an active strategic tool.

Why It Matters for Your Business

Getting a handle on this discipline is fundamental to growing your business sustainably. It’s how you stop the dreaded “budget creep” that turns a promising project into a financial nightmare. When you have a crystal-clear view of each project’s financial performance, you can bill clients accurately, forecast revenue with more confidence, and figure out which types of projects are actually your most profitable.

You can learn more about how project management and accounting work in tandem to build a stronger financial foundation for your business. In the end, it’s about shifting from just completing projects to completing them profitably and predictably, every single time.

The Four Pillars of Project Accounting

To get a real handle on project accounting, you don’t need to become a CPA overnight. A better way to think about it is like a sturdy table built on four legs. Each one is critical, and together, they support the whole structure—giving you a complete financial picture of every single project. This is what moves you from guesswork to genuine confidence in your decisions.

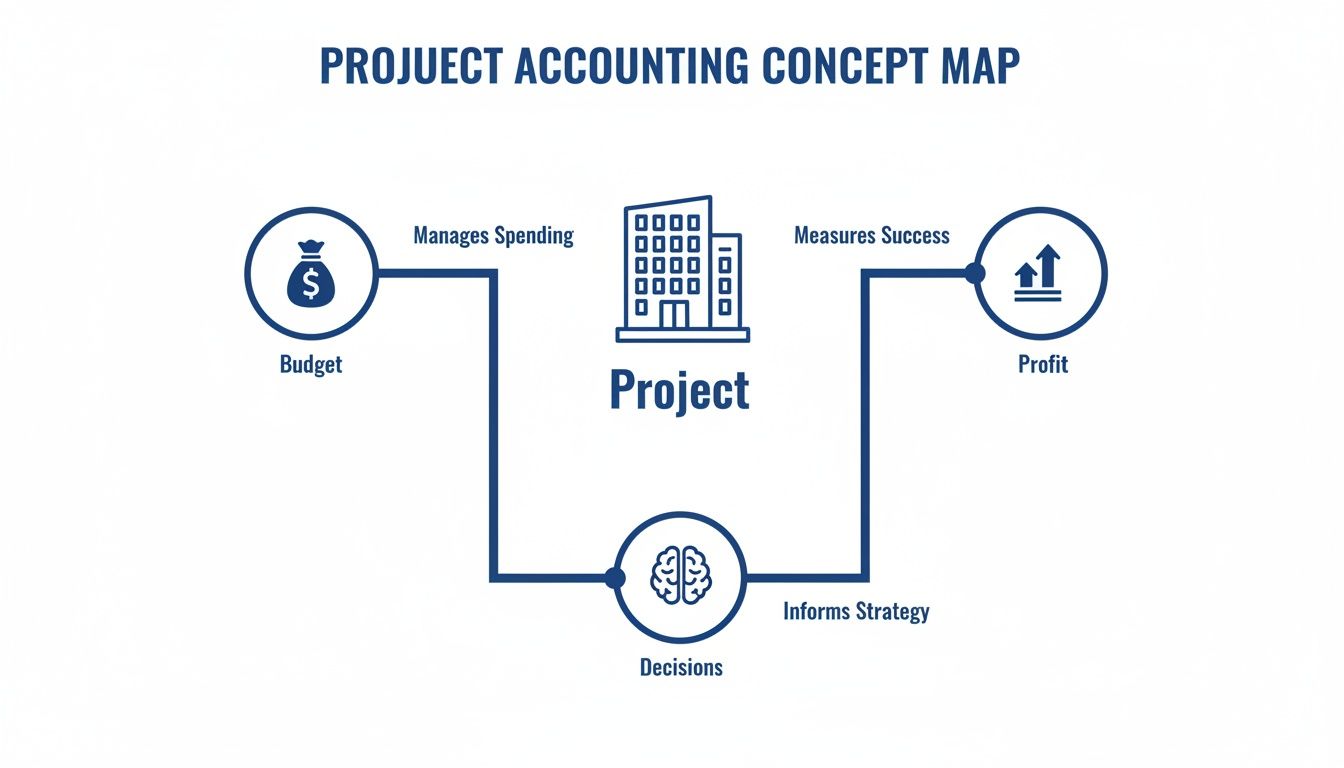

This visual really nails down how a project’s budget, its profitability, and the big decisions you make are all tangled up together in a good project accounting setup.

What this shows is that a project isn’t just some creative or technical task. It’s a mini-business in its own right, and it needs careful financial management to turn a profit and guide your next move. Let’s break down each of these foundational pillars.

Pillar 1: Project Budgeting and Forecasting

This first pillar is your project’s financial roadmap. A project budget isn’t just some number you pull out of a hat at the start and hope for the best. It’s a living, breathing document that maps out every dollar you expect to spend and earn. It’s your baseline for success.

Forecasting is the other side of that coin. It’s the ongoing process of looking at where you are now and predicting where you’ll end up financially. If the budget is your map, forecasting is your live GPS, constantly recalculating the ETA based on traffic and wrong turns.

Here’s a practical example: Imagine a marketing agency signs a six-month contract to run a digital ad campaign.

- Budgeting: They build a budget earmarking $30,000 for ad spend, $20,000 for the design team’s time, and another $10,000 for copywriting and project management.

- Forecasting: Two months in, they notice ad costs are running 15% hotter than planned. Their forecast immediately flags a potential $4,500 budget overrun. This gives them the chance to tweak the ad strategy or have a conversation with the client before the budget is blown.

Pillar 2: Time and Expense Tracking

If your budget is the roadmap, then time and expense tracking is the fuel gauge and the odometer. It tells you exactly how far you’ve gone and how much gas you’ve burned to get there. This pillar is the absolute lifeblood of accurate project accounting. Without solid data on where hours and dollars are going, your financial reports are just well-intentioned fiction.

Getting your team to track their time religiously can feel like herding cats, but it’s completely non-negotiable for any firm selling its expertise. Your team’s billable hours are your core product.

Effective project accounting has a massive impact on cost overruns. A global analysis found major projects overshoot their budgets by an average of 20–45%. But—and this is a big but—organizations with formal project accounting practices report a 10–25% drop in budget variance and a 15–20% boost in on-time delivery.

Pillar 3: Revenue Recognition

This pillar tackles a surprisingly tricky question: when do you actually count the money you’ve earned? It’s not always as simple as “when the check clears.” Revenue recognition is a formal accounting principle that dictates how and when you report income to keep your financial statements accurate and compliant.

For any project that spans more than a month or two, you can’t just wait until the very end to book all the revenue. A few different methods exist to handle this properly:

- Percentage-of-Completion: You recognize revenue in lockstep with the work you’ve finished. If a software development firm is 25% through building a $100,000 app, they can recognize $25,000 of revenue in their books for that period.

- Completed Contract: All revenue and profit are recognized only when the project is 100% finished and delivered. It’s simpler, but it gives you zero insight into how you’re performing along the way.

- Milestone Billing: Revenue is booked as you hit specific, pre-agreed project milestones that the client signs off on. For instance, a video production company might bill 25% after the script is approved, 50% after filming, and the final 25% upon delivery.

Pillar 4: Job Costing and Allocation

The final pillar, job costing, is where it all comes together to show you a project’s true profitability. This is the nitty-gritty process of assigning every single cost—both direct and indirect—to the specific project that created it.

This is what truly separates project accounting from general bookkeeping. It’s not enough to know your firm spent $5,000 on software last month; you need to know which projects actually used that software and should carry a piece of that cost.

- Direct Costs: These are easy. They’re expenses directly tied to one project, like a designer’s billable hours or the stock photos you bought for a specific client’s website.

- Indirect Costs (Overhead): These are the general costs of doing business, like rent, software subscriptions, or the salaries of your non-billable admin staff. These costs get “allocated” across your active projects using a fair and consistent formula, like a percentage of total labor costs.

By putting these four pillars to work, you stop looking at your finances as just a historical record. Instead, they become a powerful, forward-looking tool for strategic project accounting management.

Tracking Your Project Financial Health With KPIs

So, how can you tell if a project is a quiet success story or a slow-motion financial disaster brewing under the surface? Waiting until the final invoice is sent is way too late.

The secret is to monitor its vital signs in real time. For that, you need Key Performance Indicators (KPIs). Think of KPIs as your project’s financial dashboard—giving you at-a-glance insights that help you steer clear of trouble before it starts.

These metrics aren’t just for the finance team; they’re incredibly practical tools for project managers and firm owners. They translate complex financial data into simple, actionable signals telling you whether you’re on time, on budget, and actually on track to make a profit.

The Most Important Project Accounting KPIs

Solid project accounting management really comes down to tracking a few core metrics. Let’s break down the essential KPIs that every service-based business should have on its radar.

1. Project Margin This is the ultimate profitability scorecard for any single project. It tells you exactly what percentage of a project’s revenue is actual profit after you’ve paid for all the direct costs.

- Example: A web design project billed for $50,000 had $35,000 in costs (think designer salaries, stock photos, software subscriptions). The project margin is 30% (($50,000 - $35,000) / $50,000). A healthy margin like that means the project was a financial win.

2. Cost Performance Index (CPI) Think of CPI as your budget efficiency score. It measures the value of the work completed against how much you’ve actually spent to get there. A score above 1.0 is good news; below 1.0 is a serious red flag.

- Example: You’ve completed $20,000 worth of work on a consulting engagement, but you’ve already burned through $25,000 of the budget. Your CPI is 0.8 ($20,000 / $25,000). This means you’re only getting 80 cents of value for every dollar spent. This project is officially over budget.

3. Schedule Performance Index (SPI) Just like CPI, the SPI is all about timeliness. It compares the work you’ve actually completed to the work you had planned to complete by this point.

- Example: You’re at the end of month two, and the plan was to have $40,000 of work done. But in reality, you’ve only completed $30,000 worth. Your SPI is 0.75 ($30,000 / $40,000), a clear sign the project is dragging its feet.

KPIs are more than just numbers on a screen; they are the language of project performance. A low CPI or SPI isn’t a failure—it’s an early warning signal that gives you a chance to course-correct before small issues become major problems.

Turning Data Into Decisions

These numbers only become powerful when you use them to make smarter, faster decisions. A dashboard that visualizes these metrics can instantly show you which projects are humming along and which ones need immediate attention.

To get a handle on what the numbers are telling you, it helps to see them side-by-side. You can learn more about how a dedicated platform helps you monitor your financial performance with real-time dashboards and reports that do the heavy lifting for you.

Here’s a quick reference table to help you interpret these vital signs at a glance.

Essential Project Accounting KPIs at a Glance

This table breaks down the most important Key Performance Indicators (KPIs) for monitoring the financial health and efficiency of your projects.

| KPI | What It Measures | Why It’s Important | Simple Formula |

|---|---|---|---|

| Project Margin | The raw profitability of an individual project. | The clearest indicator of whether a project made or lost money. | (Revenue - Direct Costs) / Revenue |

| Cost (CPI) | How efficiently you’re using your budget. | Warns you if you’re overspending relative to the work completed. | Earned Value / Actual Cost |

| Schedule (SPI) | Whether you’re ahead of or behind schedule. | Shows if the project is on track to meet its deadlines. | Earned Value / Planned Value |

| Budget Variance | The difference between your planned and actual costs. | A direct measure of whether you’re over or under budget. | Planned Cost - Actual Cost |

| Utilization | The percentage of your team’s available time that is billable. | Reveals if your most valuable resource—your team—is generating revenue. | Billable Hours / Total Available Hours |

By consistently keeping an eye on these KPIs, you can shift from reactive problem-solving (putting out fires) to proactive project management.

You’ll be able to spot a project heading over budget weeks in advance, reallocate resources to get a delayed project back on track, and confidently forecast your firm’s financial future with real data, not guesswork.

Getting a Handle on Common Project Accounting Headaches

Even the most buttoned-up projects can hit some financial turbulence. In the world of project accounting, a few classic challenges pop up again and again, causing sleepless nights for project managers and firm owners. The good news? These problems are almost always solvable with the right game plan and a proactive mindset.

Let’s break down some of the most frequent pain points and, more importantly, the practical, actionable ways you can get things back on track. Think of this as your friendly field guide for navigating the real-world financial bumps in the road.

The Problem of Inaccurate Time Tracking

One of the biggest culprits behind blown project costs is sloppy or inconsistent time tracking. It’s a simple concept, but the downstream effects are huge. When your team doesn’t log their hours accurately or on time, your budget-versus-actual reports become a work of fiction. This makes it impossible to invoice correctly and kills your ability to understand a project’s true profitability.

The solution isn’t just sending frustrated emails. It’s about making the process as painless as possible while being crystal clear about why it matters so much.

- Get User-Friendly Tools: Pick a software with simple, intuitive timers or mobile apps that make logging hours dead simple. The fewer clicks it takes, the more likely your team is to actually do it.

- Set Clear Expectations: Make daily timesheet submission a non-negotiable part of the workflow. Frame it as the foundational data that supports everyone’s hard work and the firm’s financial health.

- Share the Wins: When you can show the team, “Hey, because we tracked our time so well on the Acme project, we hit a 35% profit margin and can afford a new coffee machine,” it connects their daily habit to a tangible team benefit.

Scope Creep: The Silent Profit Killer

Ah, scope creep. It’s that sneaky process where small, unbilled client requests slowly pile up, adding hours and costs that were never part of the original agreement. A “quick tweak” here and a “small addition” there can quietly erode your project margin until it vanishes completely.

The only way to fight scope creep is by establishing a rock-solid change management process from day one. You need a formal system for documenting, approving, and—most importantly—billing for any work that falls outside the initial scope.

A formal change order process isn’t about being difficult with clients. It’s about maintaining transparency and protecting the financial integrity of the project for both sides. It turns a potential conflict into a structured business conversation.

This process ensures every change is a conscious, documented decision, not an accidental drain on your resources. It respects the client’s evolving needs while also respecting your bottom line.

Forecasting Final Costs Accurately

“Are we going to finish on budget?” This is the million-dollar question that haunts every project manager. Bad forecasting leads to nasty surprises, like discovering you’re 20% over budget with only a week left to go. When you can’t accurately predict the final cost, you can’t manage client expectations or make timely adjustments to save the project.

Effective forecasting isn’t about gazing into a crystal ball; it’s about combining historical data with real-time performance metrics. You need a system that doesn’t just look backward at what you’ve spent but actively projects future costs based on your current progress.

- Use the Estimate to Complete (ETC) Method: This is a straightforward formula that helps you forecast the remaining funds needed. You calculate it by taking your original budget and subtracting what you’ve already spent (Budget at Completion - Actual Cost). For example, on a $50,000 project, if you’ve spent $30,000, your ETC is $20,000. This tells you exactly what you have left to work with.

- Integrate Your Systems: Your best forecasts come from integrated platforms where time tracking, expense data, and project schedules all live in one place. This completely removes the manual work of pulling numbers from different spreadsheets and gives you a single, reliable source of truth.

By tackling these common challenges head-on with clear processes and the right tools, you can transform your project accounting management from a reactive firefighting drill into a proactive system for guaranteeing profitability.

Choosing The Right Project Accounting Software

Sooner or later, every growing service-based business hits a wall with spreadsheets. What starts as a simple way to track project costs quickly becomes a tangled mess of broken formulas, outdated data, and endless manual entry. This is the exact moment when choosing the right technology for project accounting management stops being a luxury and becomes a necessity for survival.

But not all accounting tools are created equal. Trying to manage your project finances with generic, off-the-shelf accounting software is like trying to build a custom cabinet with only a hammer. It might work for the simplest tasks, but you’re missing the specialized tools needed to do the job right, leading to frustration and some seriously costly mistakes.

Generic systems are great at giving you a high-level view of company revenue and expenses, but they completely lack the project-centric focus that service businesses desperately need. They can’t easily connect a specific timesheet entry or an expense report back to a particular project’s budget, making it nearly impossible to calculate true profitability in real time.

Must-Have Features For Project-Based Businesses

When you start looking at software options, it’s easy to get distracted by flashy features you’ll never actually use. To cut through the noise, focus on the core functions that directly solve the biggest headaches of project-based work. The goal is to find a system that becomes the single source of truth for your entire project lifecycle.

Ideally, you’re looking for a platform that seamlessly integrates these key components:

- Integrated Time and Expense Tracking: Your team needs to be able to log hours and submit expenses directly against a specific project and task. This is the foundational data for everything else.

- Real-Time Dashboards: You need an at-a-glance view of “budget vs. actual” for every single project. This dashboard should instantly red-flag projects that are creeping over budget or falling behind.

- Automated and Flexible Invoicing: The system should automatically pull in all approved time and expenses to generate accurate invoices. It also absolutely must support various billing models, from fixed-fee to time and materials.

These all-in-one systems are often called Professional Services Automation (PSA) tools. To dig deeper, you can check out our complete guide on what is PSA software and see how it creates a unified workflow from the initial sale all the way to the final invoice.

The Growing Role Of AI And Cloud Technology

The software market is always evolving, with a clear shift toward smarter, more connected solutions. The global market for project management software, which includes these essential accounting modules, is projected to hit USD 12.0 billion by 2030. A huge chunk of this growth is being driven by cloud-based tools and the introduction of AI-powered features designed to automate tedious, routine tasks. You can learn more about these key project management trends and their impact on the market.

AI is no longer some futuristic concept; it’s becoming a practical assistant for project managers. Newer tools can automatically categorize expenses, flag weird timesheet entries, and even provide early warnings about potential budget risks based on current spending patterns. This frees up your team to focus on strategy, not data entry.

A Checklist For Evaluating Your Options

To simplify your search, it helps to use a structured approach when comparing different platforms. The best choice depends entirely on your firm’s specific needs, whether you’re a small creative shop or a large engineering consultancy. This checklist provides a simple framework to help you make a confident decision.

Feature Checklist for Project Accounting Software

Before you sign on the dotted line, run your top contenders through this checklist. This isn’t about finding a tool with the most features; it’s about finding the tool with the right features for how your business actually operates.

| Feature Category | Essential Features to Look For | Why It Matters for Your Business |

|---|---|---|

| Financial Management | Real-time budget tracking, automated invoicing, job costing, expense management. | Gives you an accurate, up-to-the-minute view of project profitability and cash flow. |

| Project & Task Management | Task assignments, deadline tracking, milestone planning, resource allocation. | Ensures projects stay on schedule and your team’s workload is balanced and productive. |

| Integrations | Seamless connection with your general accounting software (like QuickBooks or Xero) and other tools. | Eliminates double-entry and ensures your project data and company financials are always in sync. |

| Reporting & Analytics | Customizable reports on project margin, resource utilization, and client profitability. | Provides the critical business insights needed to make data-driven decisions for future growth. |

Using a structured evaluation like this helps you look past the sales pitch and focus on how a tool will perform day-to-day. It ensures the software you choose will solve your current problems and be able to scale with you as your firm grows.

A Few Common Questions

Even when you’ve got a handle on the theory, a few practical questions always bubble up right when you’re about to make a change. Let’s tackle the most common ones we hear to clear up any last-minute uncertainties.

What’s the Very First Step for a Small Business?

The single most impactful thing you can do is get your time and expense tracking right. Seriously. You can’t budget or forecast anything meaningful until you have a clean, reliable stream of data coming in.

Start by rolling out a simple tool that makes it ridiculously easy for your team to log their hours and expenses directly to a specific project. For a small marketing agency, for example, that just means tracking hours for “Client A - Ad Campaign” instead of the generic “Client A.” That tiny shift is everything—it’s the foundation for knowing your true profitability.

How Is This Different From My Regular Accounting?

Think about it like taking a photo. Your standard business accounting is the wide-angle lens. It gives you the big picture of your company’s overall financial health—total revenue, total payroll, total overhead. It’s a panoramic view.

Project accounting, on the other hand, is your zoom lens. It zooms way in to focus on the financial story of a single project, treating it like a little business of its own. It’s the only way to answer questions like, “Did that website redesign for Client B actually make us money?” Your general ledger can only tell you if the company as a whole was profitable that month.

Can This Really Help with Resource Planning?

Absolutely. In fact, it’s one of the biggest payoffs. Once you’re accurately tracking project budgets and timelines, you get an incredibly clear picture of who is working on what, for how long, and how much budget they’re burning through. That data is pure gold for resource planning.

If you see a project is consistently running ahead of schedule and under budget (meaning it has a high SPI and CPI), you know those team members might have some capacity. That means you can shift them over to help a different project that’s falling behind. It turns resource allocation from a guessing game into a smart, data-driven strategy.

How Often Should I Be Looking at Project Financials?

For any active project, a weekly review is the gold standard. It doesn’t have to be a huge, formal meeting. A quick, 15-minute check-in on the budget vs. actuals, project margin, and other key KPIs is usually all it takes to spot a problem before it spirals.

Waiting for a monthly or quarterly report is just too slow in the project world. Things can go sideways in just a couple of weeks. Frequent, lightweight reviews allow you to be proactive, making tiny course corrections along the way instead of performing major financial surgery when it’s too late. This constant, gentle oversight is what effective project accounting management is all about.

Ready to stop juggling spreadsheets and start managing your projects with clarity and confidence?

Drum brings your proposals, projects, time tracking, and invoicing into one simple platform, giving you the real-time financial insights you need to grow profitably.

Start your free 14-day trial and discover a better way to run your studio.