- Mastering Cash Flow Management for Small Businesses

- Why Cash Flow Is the Lifeblood of Your Business

- The Profit vs. Cash Distinction

- From Reactive to Strategic Operations

- Creating Your First Rolling Cash Flow Forecast

- Gathering Your Data The Right Way

- Practical Examples in Action

- Streamlining Your Invoicing and Collections Process

- Setting the Stage with Smart Contracts and Billing Models

- From Invoice Creation to Getting Paid Faster

- Creating a Follow-Up System That Works

- Managing Expenses Without Stifling Growth

- The Art of Strategic Payments

- Run a Recurring Expense Audit

- The Essential vs. Nice-to-Have Framework

- Using Technology for Better Financial Oversight

- Creating a Seamless Financial Workflow

- A Practical Scenario for a Consulting Firm

- Got Cash Flow Questions? Let’s Get Them Answered.

- How Often Should I Review My Cash Flow Forecast?

- What Cash Flow KPIs Should I Actually Be Tracking?

- Real-World Example: A Mid-Week Forecast Check-In

- How Do I Handle Late Payments from a Major Client?

- What’s One Thing I Can Do Right Now to Boost Cash Flow?

Mastering Cash Flow Management for Small Businesses

Effective cash flow management for small businesses isn’t just about accounting; it’s about tracking, analyzing, and optimizing every dollar that moves through your company. Think of it as the heartbeat of your business. At its core, it’s about making sure you always have enough cash on hand to cover payroll, invest in the right opportunities, and handle whatever surprises come your way—without having to take on debt.

It’s what gives you the confidence to run your firm with clarity and peace of mind.

Why Cash Flow Is the Lifeblood of Your Business

Let’s be honest for a moment. For any professional services firm—be it consulting, architecture, or a creative agency—cash flow is the oxygen your business breathes. It’s what determines whether you can pay your team on time, jump on hiring that perfect candidate you just interviewed, or finally invest in the software that could help you land much bigger clients.

We’ve all been there. You’ve just delivered incredible work for a client, but their invoice sits in an accounts payable queue for 30, 60, even 90 days. Meanwhile, your team’s salaries, software subscriptions, and rent are all due now. This is the classic cash flow crunch that keeps so many firm owners tossing and turning at night.

The Profit vs. Cash Distinction

One of the most dangerous traps for any business owner is confusing profitability with having actual cash in the bank. They are fundamentally different, and understanding why is critical for your survival.

Simply put, a profitable company can easily go bankrupt. Here’s a quick breakdown to illustrate the point.

| Concept | Profit | Cash Flow |

|---|---|---|

| What it is | An accounting calculation of revenue minus expenses. | The actual money moving into and out of your bank account. |

| Timing | Measured over a period (e.g., a quarter or year). | A real-time measure of liquidity available right now. |

| Example | A $50,000 project is profitable the moment it’s invoiced. | That same project only contributes to positive cash flow when the $50,000 payment actually hits your account. |

| Impact | Shows if your business model is sustainable long-term. | Shows if you can pay your bills and operate day-to-day. |

A project might look fantastic on your profit and loss statement, but if the client takes three months to pay, that “profit” can’t help you make payroll next Friday. That’s why you need to manage for cash, not just for profit.

You can be wildly profitable on paper and still go out of business because you ran out of cash. This is why mastering cash flow is a non-negotiable skill.

This isn’t just some textbook theory. A staggering 82% of small businesses fail due to poor cash flow management. That sobering statistic, especially with today’s rising operational costs, hammers home why a clear, real-time view of your money is so essential. You can find more small business trend insights at OnDeck.com.

From Reactive to Strategic Operations

When you get a handle on your cash flow, you shift from constantly putting out fires to strategically planning for the future. Instead of scrambling to cover next month’s expenses, you gain the confidence to make smart, forward-thinking decisions.

Imagine knowing with certainty that you have the runway to:

- Hire top talent the moment an opportunity arises.

- Invest in new tools and training to elevate your service quality.

- Navigate an unexpected market downturn without the usual panic.

Ultimately, this is about building a resilient, thriving business—not just surviving from one invoice to the next. Solid cash flow management is the foundation that allows you to scale thoughtfully and finally achieve your long-term vision.

Creating Your First Rolling Cash Flow Forecast

Forecasting can sound intimidating, bringing up images of massive corporations with dedicated finance teams. But for a firm like yours, it’s one of the most practical and empowering tools you can have.

Forget about rigid, set-in-stone annual budgets. We’re talking about a living, breathing document that gives you a crystal-clear view of the weeks ahead.

This is where a rolling 13-week cash flow forecast becomes your new best friend. Why 13 weeks? It gives you a full quarter of visibility—the perfect timeframe to spot trouble on the horizon and make adjustments before a small problem becomes a crisis. It’s not a spreadsheet you create once and forget about. Think of it as a dynamic tool you’ll update weekly to keep a finger on the real-time pulse of your business.

The goal here is simple: to anticipate your cash position so you can make confident decisions. Whether that’s bringing on a new team member, investing in software, or just knowing you can cover payroll without breaking a sweat.

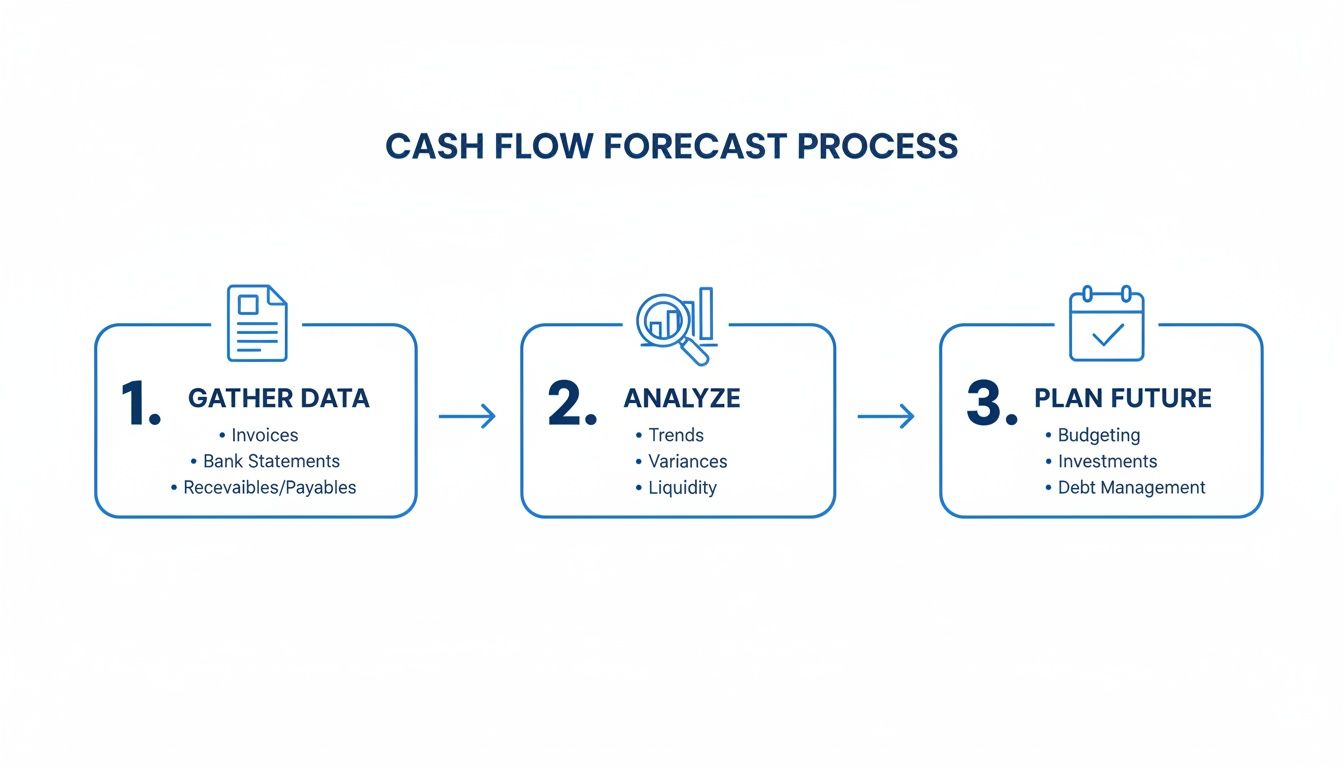

Gathering Your Data The Right Way

To build a forecast that’s actually useful, you need a clear picture of all the money coming in and all the money going out. This isn’t about guesswork; it’s about using the information you already have to make educated projections.

Your forecast really only has two main parts: cash inflows and cash outflows.

Expected Cash Inflows:

- Signed Contracts: Go through every active project and list all the payments you expect to receive. The key here is to be brutally honest about when that cash will actually land in your account, not just the invoice due date. For example, if a client consistently pays 15 days late, build that into your forecast.

- Proposals in the Pipeline: Take a hard look at your sales pipeline. For those proposals with a high probability of closing—say, 75% or higher—you can pencil in the projected initial payments. Be conservative here; it’s always better to be pleasantly surprised.

- Recurring Retainers: This is the easy part. Just list all the monthly or quarterly retainers you know are coming in.

Expected Cash Outflows:

- Fixed Costs: These are your predictable, recurring expenses that don’t change much month to month. Think salaries, rent, software subscriptions (like your accounting platform), insurance, and any loan payments.

- Variable Costs: These expenses tend to fluctuate. This bucket includes payments to contractors, project-specific material costs, marketing spend, and travel expenses.

- One-Time Expenses: Planning to buy new laptops for the team next month? Paying for annual conference tickets? Drop these expenses into the specific week you expect the cash to leave your account.

A great forecast is built on realistic assumptions. It’s far better to be pleasantly surprised by an early payment than to be caught off guard by a late one. Always plan based on past behavior, not just hopeful promises.

Practical Examples in Action

Let’s see what this looks like for a couple of different firms.

Marketing Agency Scenario: Imagine you run a small digital marketing agency. You’re mapping out your next 13 weeks.

- Inflows: You have three monthly retainers totaling $15,000, which you slot into the first week of each month. A $20,000 project milestone payment is expected in week 5. You also have a promising new proposal out for $10,000 that has an 80% chance of closing, with a 50% deposit due in week 8.

- Outflows: Fixed costs include $12,000 in salaries every two weeks, $3,000 in monthly rent, and $1,500 for software. You also need to pay a freelance copywriter $4,000 in week 6 for that project milestone.

By laying this all out, you immediately spot a potential cash dip in week 7, right before that new client’s deposit is expected to hit. This foresight allows you to be proactive—you can either follow up on the milestone payment more diligently or push back a non-essential software purchase.

Architecture Firm Scenario: Now, let’s say you’re an architecture firm dealing with longer project timelines and less predictable payment schedules.

- Inflows: You have a huge payment of $40,000 tied to a permit approval, which could honestly happen anytime between week 4 and week 9. You conservatively place this income in week 9. On top of that, you have two smaller, fixed-fee design projects with payments of $5,000 each due in weeks 3 and 11.

- Outflows: Besides payroll and rent, you anticipate paying a structural engineering consultant $8,000 in week 5. You also have a large printing and plotting expense of $2,500 lined up for week 7.

The forecast instantly shows that your cash position is heavily dependent on that single $40,000 payment. If it gets delayed, you could face a serious shortfall. This insight prompts you to start conversations with the client early to get a more concrete payment timeline.

This whole process gets a lot easier when your financial data is organized and accessible. For instance, an integration with QuickBooks can ensure your accounting data flows seamlessly into your forecasting process, saving you hours of tedious manual entry. Connections like this help create that single source of truth you need for accurate planning.

Think of your first forecast as a baseline—a starting point that will only get more refined and accurate each week you update it.

Streamlining Your Invoicing and Collections Process

A perfect forecast is a fantastic start, but it doesn’t mean much if the cash you’re projecting never actually arrives. The gap between finishing great work and getting paid for it is where many small firms run into trouble. Tightening up your invoicing and collections process is one of the most direct ways to improve your cash flow.

This isn’t about hounding clients or becoming a collections agency. It’s about building a clear, professional, and consistent system that sets expectations from day one and makes it easy for clients to pay you on time. A smooth process reduces awkward conversations and strengthens client relationships, all while keeping your bank account healthy.

Setting the Stage with Smart Contracts and Billing Models

Your invoicing process actually begins long before you send the first bill—it starts with your proposal and contract. This is your first and best opportunity to establish clear payment expectations.

Ambiguity is the enemy of good cash flow. Your contracts should explicitly state:

- Payment Due Dates: Clearly specify terms like “Net 15” or “Due Upon Receipt.” Don’t leave it open to interpretation.

- Payment Milestones: For larger projects, tie payments to specific deliverables or phases. This breaks up large invoices and creates a steadier stream of income.

- Late Fee Policies: Include a simple clause about interest on overdue invoices. Even if you rarely enforce it, its presence signals professionalism and sets a serious tone.

The billing model you choose also has a massive impact. Each has its place, and picking the right one for the job can make a world of difference.

| Billing Model | Best For | Cash Flow Impact |

|---|---|---|

| Fixed-Fee | Well-defined projects with a clear scope, like a website design. | Predictable, but can lead to cash crunches if milestones are far apart. |

| Time & Materials | Projects where the scope is likely to evolve, like ongoing consulting. | Flexible, but revenue can be less predictable month-to-month. |

| Retainer | Ongoing, recurring work for a client, like social media management. | Excellent for creating a stable, predictable monthly cash inflow. |

For an engineering firm, a large project might be structured with an initial deposit (25%), another payment upon submission of preliminary designs (25%), another at permit approval (30%), and the final 20% upon project completion. This milestone-based approach aligns your cash inflows directly with your work output.

From Invoice Creation to Getting Paid Faster

Once the work is done, speed is your friend. Don’t wait until the end of the month to bill for completed work. The sooner your invoice is in the client’s system, the sooner it gets into their payment queue.

To make your invoices more effective, ensure they are crystal clear. Include a specific contact person, the project name, a detailed breakdown of services rendered, and, most importantly, clear instructions on how to pay. Providing multiple payment options (like credit card or ACH) removes friction and often speeds up payment. Tools like QuickBooks make this easy, and our guide on invoicing in QuickBooks Online can walk you through setting this up efficiently.

This simple flow—gathering data, analyzing it, and then planning for the future—is the engine that powers proactive financial decisions. It’s a cycle, not a one-time task.

Creating a Follow-Up System That Works

Chasing payments is uncomfortable for everyone, but a structured follow-up system can make it a painless, routine part of your business operations. Automation is your best friend here.

Consider setting up a simple, automated email sequence:

- A Week Before Due Date: A friendly “heads-up” email.

- On the Due Date: A simple reminder that the payment is due today.

- A Week After Due Date: A polite but more direct follow-up.

Example Gentle Reminder (7 Days Past Due): Hi [Client Name],

Hope you’re having a great week!

This is just a friendly reminder that invoice #1234, for [Project Name], was due last week. You can view the invoice and pay online here: [Link]

Please let me know if you have any questions.

Thanks, [Your Name]

This approach is professional, non-confrontational, and often all that’s needed to get an invoice paid. It keeps your cash flow moving without damaging hard-won client relationships.

Managing Expenses Without Stifling Growth

Getting cash in the door faster is a massive win, but it’s only half of the cash flow story. Truly effective cash flow management for small businesses also means keeping a close eye on your cash outflows.

The goal here isn’t to pinch every last penny. It’s about being strategic, making sure every dollar you spend is pulling its weight without cutting so deep you stunt your own growth. This is all about intentional spending, nurturing strong vendor partnerships, and aligning your outflows with the natural rhythm of your project income. A few small tweaks to your payables strategy can make a huge difference to your daily liquidity.

The Art of Strategic Payments

For any professional services firm, the biggest line items are almost always payroll and payments to contractors or suppliers. Payroll is pretty much fixed—a non-negotiable cost of doing business. But you’d be surprised how much flexibility you have with your other payables.

This is where building great relationships really pays off. When you’re a good client—the kind that communicates clearly and pays reliably—you earn the trust to have a real conversation about payment terms.

For example, let’s say your architecture firm hires a specialized engineering consultant for a big project. The consultant’s standard invoice says Net 30. But you know your own client payment for that phase won’t land for another 45 days. You can proactively ask the consultant for Net 45 terms. It’s a simple change, but it perfectly aligns the cash outflow with its related inflow, preventing a nasty, if temporary, cash crunch.

Don’t be shy about negotiating payment terms. Many vendors and freelancers are willing to work with you on Net 45 or even Net 60, especially for reliable, long-term partners. It’s a simple conversation that can seriously improve your cash position.

Run a Recurring Expense Audit

One of the quickest ways to free up cash is to get ruthless with your recurring expenses. It’s amazing how fast those small monthly software subscriptions and “temporary” tools stack up and start draining your bank account.

Set a recurring reminder in your calendar—once a quarter is a good cadence—to do a deep dive. Go through your bank and credit card statements line by line and ask some tough questions about every single subscription:

- When did we last actually use this? Be brutally honest. If no one on your team has logged into a piece of software for over a month, it’s a prime candidate for the chopping block.

- What’s the real ROI here? Can you draw a straight line from this tool to increased revenue or efficiency? If the benefit feels fuzzy or vague, it might be time to say goodbye.

- Is there a better, cheaper alternative? The software market moves incredibly fast. The best-in-class tool from last year might have a more affordable and capable competitor today.

The Essential vs. Nice-to-Have Framework

To make these decisions easier and take the emotion out of it, try categorizing your expenses. This simple framework gives you a crystal-clear picture of where your money is going and where you can cut back without hurting your core operations.

Here’s a simple way to break it down:

- Essential: These are the absolute non-negotiables. Think payroll, rent, your core project management and accounting software, and insurance. The business doesn’t run without them.

- Important: These expenses aren’t strictly vital for survival, but they directly fuel growth and efficiency. This bucket includes your marketing budget, professional development for your team, or specialized analytics tools.

- Nice-to-Have: These are the perks. The discretionary costs that boost morale but aren’t tied directly to operations. This is your catered lunches, premium coffee subscription, or tickets to industry happy hours.

When cash gets tight, the “Nice-to-Have” list is the very first place you should look for savings.

This kind of disciplined review also gives you a much better handle on your company’s overhead. In fact, we put together a more detailed guide on our blog that explains exactly how to calculate your overhead rate, giving you even deeper insight into your cost structure.

By thoughtfully managing both your payment timing and your recurring costs, you’ll maintain the cash buffer you need to operate smoothly—and more importantly, to jump on new opportunities the moment they appear.

Using Technology for Better Financial Oversight

If you’re still wrestling with manual spreadsheets and a patchwork of disconnected systems, you’re not alone. But those tools are often the silent killers of efficiency and financial clarity. When you’re juggling one app for time tracking, another for project management, and a third for invoicing, it’s a recipe for lost hours, delayed billing, and a perpetually foggy view of your cash position.

The good news? Modern tech offers a powerful way out of this mess, bringing everything under one roof.

Building a modern tech stack isn’t about collecting dozens of fancy apps. It’s about creating a single, reliable source of truth. For professional services firms—consultants, architects, engineers, agencies—this usually revolves around a Professional Services Automation (PSA) platform. Think of a PSA as the central operating system for your entire business, connecting the dots from the first client conversation all the way to the final paid invoice.

This integrated approach is where you really start to win back control. When your team’s time tracking is directly linked to project tasks and invoicing, revenue leakage from unbilled hours practically vanishes. Every minute of work gets captured and accounted for, so you can be sure you’re billing for everything you’ve earned.

Creating a Seamless Financial Workflow

The real magic happens when you connect your PSA to your accounting software, like Xero or QuickBooks. This integration creates a smooth, two-way flow of information that automates the tedious stuff and gives you real-time insights that were once impossible to get without hours of manual reconciliation.

When your systems talk to each other, data just flows:

- Instant Invoicing: As soon as a project milestone is hit or timesheets are approved, invoices can be generated and fired off with just a few clicks.

- Synced Financials: Payments recorded in Xero or QuickBooks are automatically reflected in your project profitability reports inside the PSA.

- Real-Time Profitability: You can see, at a glance, which projects are on budget and which are bleeding money, allowing you to make adjustments before it’s too late.

This completely eliminates that all-too-common scramble of digging through multiple spreadsheets and platforms just to figure out if a project is actually making money.

A Practical Scenario for a Consulting Firm

Let’s picture a small engineering consulting firm that just made the switch to an integrated system. Before, they were constantly chasing down timesheets, manually building invoices piece by piece, and then re-keying all that data into QuickBooks. It was a time-suck, and every step was an opportunity for error.

Now, with a unified platform, their workflow is night and day.

- Engineers track time directly against specific project tasks inside the PSA. That data is immediately visible to the project manager.

- The project manager keeps an eye on the budget in real-time. If a project is creeping toward its hourly cap, they get an automatic alert.

- Once a phase is done, the project manager generates an invoice from the approved timesheets with a single click.

- That invoice is automatically synced to QuickBooks. When the client pays, the payment status updates across both systems.

The result? The firm claws back dozens of admin hours every single month. More importantly, the owner has a continuously updated, crystal-clear view of project profitability, accounts receivable, and overall cash flow. They’re making strategic decisions based on live data, not last month’s stale reports.

A modern financial dashboard provides this kind of immediate clarity. Here’s a feel for what this real-time oversight looks like.

This kind of visual report instantly surfaces key metrics like project budgets, hours logged, and invoicing status, giving you an at-a-glance health check of your firm.

The goal of technology isn’t just to automate tasks; it’s to provide the clarity you need to make better, faster decisions. When your data is unified, you spend less time managing software and more time managing your business.

By ditching the siloed tools and embracing an integrated system, you’re not just getting more efficient. You’re building a more resilient, predictable business. Effective cash flow management for small businesses today depends on having accurate, real-time information at your fingertips—and the right tech stack is what makes that possible.

Got Cash Flow Questions? Let’s Get Them Answered.

Most professional services firms I talk to are wrestling with the same cash flow questions. It’s a constant source of stress, but it doesn’t have to be.

Let’s walk through the most common concerns I hear and give you some actionable answers. We’ll cover how often to check your forecast, which metrics actually matter, how to deal with late-paying clients (even the big ones), and what you can do right now to get cash in the door.

For instance, a friend of mine runs a boutique design studio. She recently used her weekly forecast to spot a $10,000 shortfall just before month-end. That simple check-in gave her enough time to act, not react.

How Often Should I Review My Cash Flow Forecast?

For small firms with lumpy, project-based income, a weekly forecast review is non-negotiable. Seriously. Put a recurring 30-minute block on your calendar every Friday morning.

This simple habit is your early warning system. It helps you catch delayed client payments or unexpected expenses before they snowball into a crisis. If you absolutely can’t manage weekly, aim for twice a month at a minimum. Anything less and you’re flying blind.

Tip: A regularly updated forecast isn’t just a report; it becomes a strategic tool that helps you make proactive decisions instead of constantly putting out fires.

What Cash Flow KPIs Should I Actually Be Tracking?

It’s easy to get lost in a sea of metrics. To avoid analysis paralysis, just focus on these three. They tell you 90% of the story you need to know.

- Days Sales Outstanding (DSO): In simple terms, this is the average number of days it takes for a client to pay you after you’ve sent an invoice. A lower number here means you have a healthier, faster cash cycle. Aim to keep it under 45 days.

- Cash Conversion Cycle (CCC): This measures the time it takes from paying your own suppliers to collecting the cash from your clients. It’s a direct indicator of your liquidity and operational efficiency.

- Current Ratio: This one’s simple: it compares your current assets to your current liabilities to show if you can cover your short-term bills. A ratio above 1.5 is a good sign you’re on solid ground.

Stick these three on a simple dashboard and check them weekly. That’s it.

| KPI | Healthy Range |

|---|---|

| DSO | < 45 days |

| CCC | 30–60 days |

| Current Ratio | 1.5–3.0 |

This simple discipline will help you spot potential cash gaps long before they start impacting operations.

Real-World Example: A Mid-Week Forecast Check-In

I was working with an architecture firm that discovered a looming mid-quarter shortfall during a routine Wednesday forecast review. It wasn’t a huge deficit, but it was enough to cause problems.

Because they caught it early, they had options. They simply delayed a non-essential software purchase and reached out to a client to request early payment on a $15,000 milestone. Problem solved, no drama.

How Do I Handle Late Payments from a Major Client?

It’s a classic dilemma. Your biggest client is also your slowest payer, and you don’t want to rock the boat. But letting their invoices drift into a 60- or 90-day approval queue can cripple your cash flow.

First, make sure your own house is in order. Are your payment terms crystal clear in your contracts? Is every invoice accurate before it goes out the door? Once that’s settled, you can get more proactive.

- Automate gentle reminders. A simple, polite email a few days before and after the due date can work wonders without being pushy.

- Negotiate better terms upfront. For the next project, ask for a larger deposit or switch to a shorter billing cycle to better align your cash timing with theirs.

- Offer a small discount for early payment. A 1–2% discount for paying within 10 days can be a powerful incentive to get you to the top of their AP pile.

Insight: Don’t be afraid to pick up the phone. A polite, direct conversation can often uncover a simple administrative snag that’s holding up your payment.

Here’s a simple email template that just works:

Hi [Client Name],

Hope you’re having a great week!

Just a friendly reminder that invoice #5678 for [Project] was due last week. You can pay directly through this link: [payment link].

Please let me know if you need anything from my end.

Thanks, [Your Name]

It’s concise, helpful, and professional. It gets the job done without damaging the relationship.

What’s One Thing I Can Do Right Now to Boost Cash Flow?

Your aged receivables report. That’s where your cash is hiding.

Pull up your accounts receivable aging report from Xero or QuickBooks and zero in on every invoice that’s over 30 days past due.

- Make a list of every client with a balance over 30 days old.

- Send each one a personalized reminder email with a direct payment link. Make it as easy as possible for them to pay you.

- If you don’t hear back in a day or two, follow up with a quick phone call to see if there’s an issue blocking payment.

This focused, tactical effort can often bring a surprising amount of cash into your account in just a few days. I once saw an agency recover $8,000 in a single afternoon with this exact method.

That cash covered half a month of salaries and kept them on track for a planned software upgrade. It’s simple, but it’s incredibly effective.

These questions cover the core challenges most small firms face with cash flow. If yours isn’t listed here, schedule a quick, free demo and we can talk through some practical, personalized advice for your business.

Ready for clear, real-time cash flow insights? Sign up for a free 14-day trial and discover how Drum unifies forecasting, invoicing, and reporting in one platform designed for firms like yours.

Ready for clear, real-time cash flow insights? Sign up for a free 14-day trial and discover how Drum unifies forecasting, invoicing, and reporting in one platform designed for firms like yours.</p>

Start your free 14-day trial and discover a better way to run your studio.

</blockquote>